Summary

- Generally speaking, the larger MSOs continue to execute, while its becoming more of a struggle for the smaller players to scale and generate cash flows needed to support current operations. Q2 revenues came in as expected – minimal sequential growth, but improvement from Q1 vs Q4:21.

- In Q2, more branded products were sold through retail vs wholesale which led to improved gross margins for some MSOs with vertically integrated operations (albeit most likely with the consequence of a higher 280E burden).

- In the absence of established industry standards/best practices (on a variety of fronts), it remains difficult to make financial and operational comparisons that are on equal footing, particularly because there are inconsistencies with respect to financial reporting ( i.e. adjusted EBITDA calculations vary, gross margins can differ based upon type of operation and accounting treatment etc).

The industry continues to evolve with ongoing M&A activity as new and existing participants jockey for leadership positions. To this end, we would not be surprised (nor should investors) for ongoing volatility in the quarterly reporting of gross and EBITDA margins due to variations in the timing of deal closings and integration costs. The added costs of prohibition could become increasingly problematic for many of the smaller operators which could provide an opportunity for the better capitalized concerns to make accretive acquisitions at distressed levels.

August Stock Performance

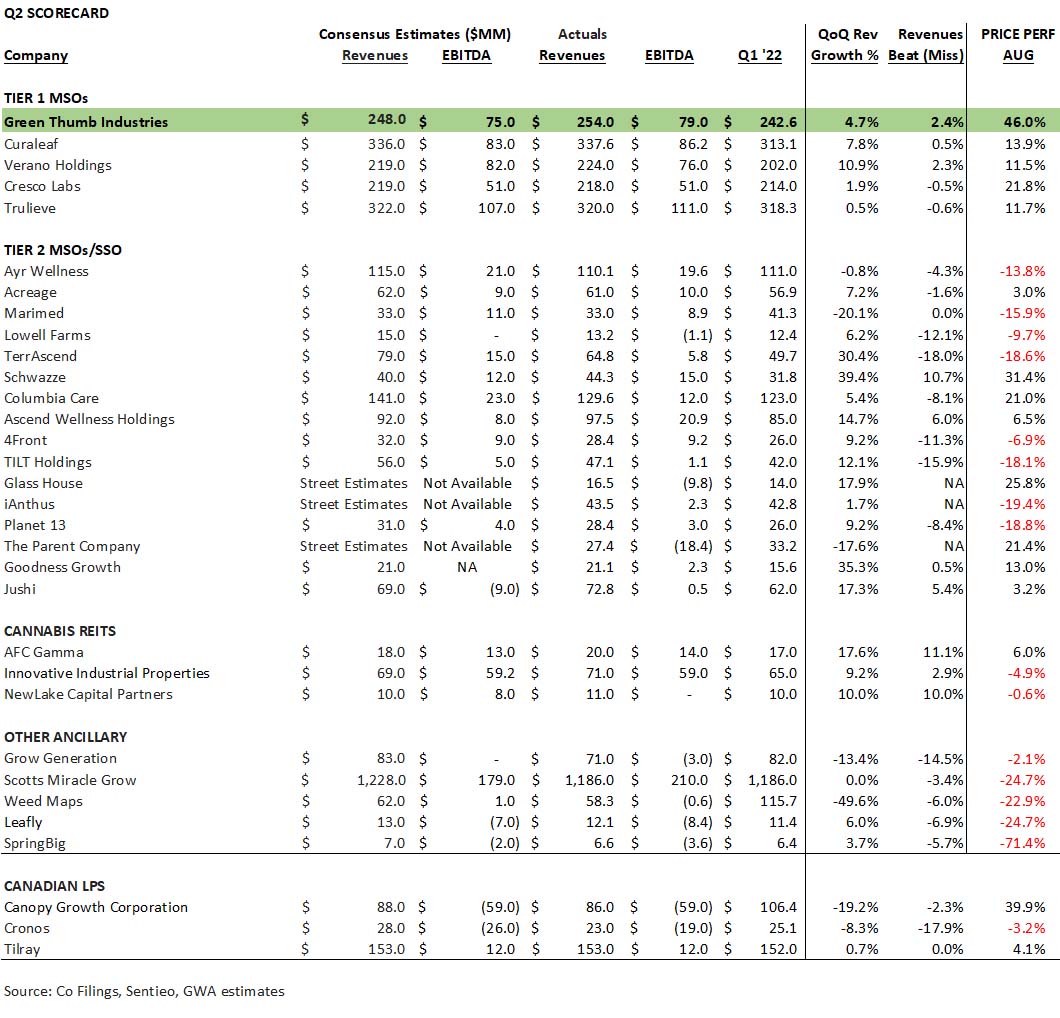

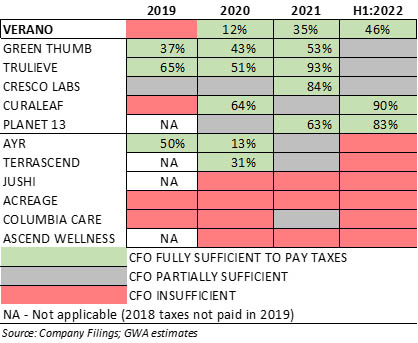

Most companies reported the June quarter in August. As noted below (see table 1), most of the larger MSO’s fared well likely due to improved fundamentals including sequential revenue growth, a beat on the top line (vs street expectations), improved gross margin (due to a shift in strategy as noted above) and continued execution in generating enough cash to pay the extraordinary 280E tax burden (see table 2). The ancillary businesses were down sharply in the month all missing street expectations on revenues.

Table 1: Quarter Ending June 30th – Scorecard

Table 2: Taxes Paid as % Cash Flow From Operations (CFO)