Summary:

- The state of California is owed ~$732M in arrears for sales & use, excise and cultivation taxes including penalties and interest. The vast majority (72%) is due from establishments that are out of business.

- The California Department of Tax and Fee Administration (CDTFA) has identified and assessed $173M in excises tax on illicit sales consummated at unlicensed establishments. The implied sales value is $1.2B (~25% of 2023 $4.4B cannabis sales).

- We estimate distributors owe a total of ~$1.2B to the state of California and product manufactures (brands) as of January 31, 2024, up from $1B as of June 30, 2023.

Full Article

Details:

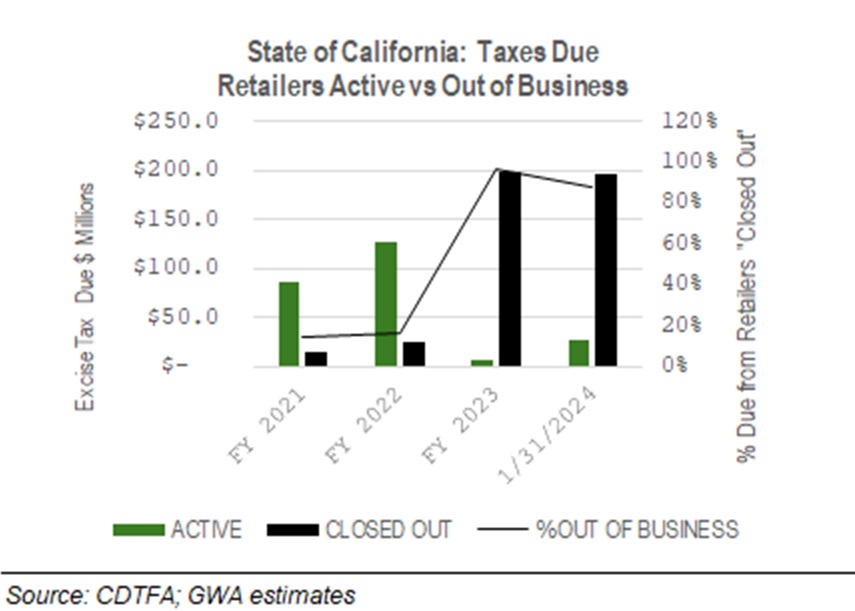

- The California Department of Tax and Fee Administration (CDTFA) provided us with its most recent compilation of delinquent taxes with penalties and interest owed from distributors (as of 1/31/24). This is an update to our prior analysis (see The GreenWave Buzz: “Distribution Mayem in California: Whose Left Holding the Bag. Approximately $732M stands in arrears, of which 72% ($527M) is due from establishments that are no longer in business.

- Interestingly, we learned that the CDTFA has identified $173 million in excise taxes that it has imposed on illicit cannabis shops. This translates into an implied sales value of ~$1.2 billion (15% excise tax), likely representing just a fraction of the state’s legacy market. If consumers made these purchases through legal channels, reported sales would have been 27% greater than the $4.4 billion reported in 2023, underscoring the state’s market potential.

- We determined the estimated retail sales values for the excise taxes and potential amounts owed to product manufacturers (brands). If the distributors cannot remit taxes collected from retailers to the state, it is likely brand manufacturers will also go unpaid. We estimate distributors owe ~$1.2B as of January 31, 2024, up from the $1B we estimated as of June 30, 2024 (we excluded the calculation on illicit sales because it’s unclear where these products come from).

- California is the largest cannabis market in the U.S., which, at maturity, we estimate at ~$7B. In 2023, sales increased 16% yearly to $4.4 B from $3.8 B. In July, we identified a widespread and material misinterpretation of actual sales reported from 2018-2022, which was overstated by ~$6B during this time frame. (The GreenWave Buzz “Stirring the Pot in California”).