KEY POINTS:

- With 3 years of public disclosures, we are better able to analyze and assess the financial and operational performance of the U.S. Multistate Operators (MSOs).

- The added costs of prohibition (most notably 280E tax, which, in some cases can trigger an ~60-70% effective rate) are significant and when federal legalization occurs (however defined), and the extra costs no longer required, cash flow profiles will accelerate significantly (and share prices will likely surge).

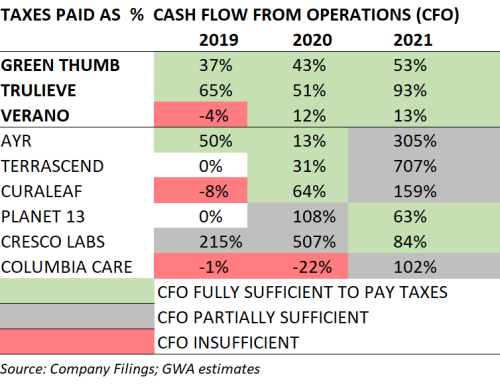

- But, even as these headwinds persist, there are a few outliers that have generated enough cash from operations to foot such an egregious tax bill (see below),

- As the industry continues to evolve, we expect continued volatility in reported gross and EBITDA margins as the nature, extent and timing of integration efforts will likely vary with ongoing M&A activity. Accordingly, operational prowess is better measured by sustainable cash flow generation.