- Northern Lights Acquisition Corp (NLIT) extended the closing of its business combination with Safe Harbor Financial to July 29th (but could go to August 31st ) as the company waits for regulatory approval. An extension is not uncommon (i.e. last year, Subversive Acquisition LP / InterCure approved 4/6, extended to 8/31 closed 4/23; 9/1 shares began trading) and note that each deal’s structure is unique with varying complexities — “one size does not fit all”.

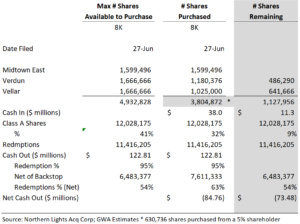

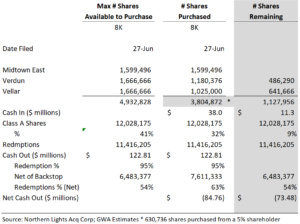

- NLIT made provisions for a redemption backstop of up to $50M via Forward Purchase Agreement (FPA) for an OTC Equity Prepaid Forward Transaction with Midtown East Management NL LLC (Midtown); Midtown. This translates to just under 5M shares ($10.21/ share).

- Midtown entered into assignment and novation agreements with Verdun Investments LLC (Verdun) and Vellar Opportunity Fund SPV LLC1 Vellar), pursuant to which Midtown assigned 1,666,666 shares to both Verdun and Vellar.

- Redemptions were 95% (~$122M) ; 63% net of ~ 3.8M FPA shares purchased (~ $38M). Net reduction to NILT’s cash balance ~$84M. It appears NILT will meet the required ~$5M in net tangible assets required for the deal to close.

Table 1: Redemption Analysis

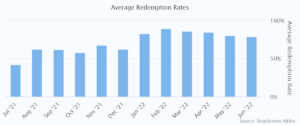

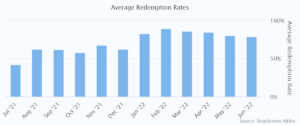

As shown in the chart below, redemption rates have risen since the beginning of the year. Cannabis SPACs in particular have faired worse this year (e.g. Tuatara/SpringBig also ~95% redemption) likely due to the added uncertainties around federal legalization.

Table 2: SPAC Redemptions

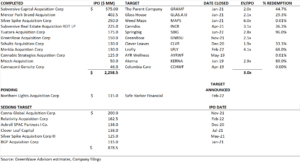

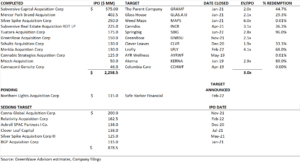

As illustrated below, cannabis SPAC targets have on average a valued of 3.0x the IPO proceeds (amount in trust). Currently, there is a pipeline of ~$880 M which implies ~$2.6B in deal value which may prove difficult to complete, given the current envirornment.

Table 3: Cannabis SPACs

To better understand this transaction we reviewed NILT’s SEC disclosures:

June 17th : Announced “redemption backstop of up to $50M via Forward Purchase Agreement (FPA) for an OTC Equity Prepaid Forward Transaction with Midtown East Management NL LLC (Midtown). This translates to just under 5M shares ($10.21/ share).

The FPA helps ensure the maximum redemption threshold will be met, increasing the likelihood that the transaction will close. Typically how this would work is the day after SHF becomes a publicly traded entity, it would reimburse Midtown and Atalya for the purchase price of the shares. If SHL stock increases, the Midtown East can sell its shares and keep the profit.

June 22nd : 11,416,205 shares redeemed; ~95% of the 12,028,175 Class A shares.

June 27th: Midtown East, Verdun and Vellar purchased 1,599,496, 1,180,376 and 1,025,000 shares at an average purchase price per share of $10.21 (3.8M).

June 29th: Boothbay sold its 3.9M shares – Form 4 Filed = $39M on the open market.

July 7th : Form 3 filed (Initial Statement of Beneficial Ownership of Securities) with the SEC naming Atalaya Special Purpose Investment Fund II LP and Atalaya Capital Management LP as beneficial owners along with Midtown East. Atalaya is an alternative asset manager and has been active in the space.

_________________________________________________________________________

Northern Lights Acquisition Corp

NLIT brings a deep bench of Wall Street and Cannabis industry experience to SHF. As such, it is able to leverage its financial expertise to better steward the transition from a private to public concern. The team is led by Co-CEOs, John Darwin and Joshua Mann both of which are Co-founders of Luminous Capital, a private equity firm that focuses on high growth, emerging-market industries.

Safe Harbor Financial

The company’s investment thesis (see investor deck):

- Leading Provider of Cannabis Related Financial Services in the US

- Unique low cost of capital lending

- Deep expertise in building complaint banking and Financial solutions for CRBs

- Platform to consolidate highly fragmented cannabis financial services industry

- Team with the knowledge and experience to execute on strategy

In 2017, we published, “Navigating the Shoals of Cannabis Banking” in part to help investors better understand the limitiations and complexities of cannabis banking . At the time, we asserted “until such time as the federal government ends prohibition or passes legislation to change existing laws that the cannabis industry will be impelled to seek out temporary solutions to facilitate banking transactions. It is hoped that some of these work-arounds will be suited for longer term viability and will (or continue to) stand the tests of regulatory scrutiny.”

Safe Harbor Financial (Source: shfinancial.org)

“Safe Harbor Financial was conceived in 2015 as a solution to a major problem that plagued the nascent legalized cannabis industry in Colorado– access to reliable and compliant financial services. Once SHF addressed the local Colorado issues surrounding lack of banking and industry participants became banked, clients started seeking out of state licenses; leading SHF to a national presence and the establishment of a national foundation that enabled SHF to solve the same issues on a national level. As a result, Safe Harbor presently processes funds from 20 different states nationally.

Safe Harbor, realizing the funds from the cannabis industry were better banked than unbanked, ventured forward to do the right thing for everyone, bank the deposits under Partner Colorado Credit Union as a DBA up until 2021. Cannabis related funds were already finding their way into the financial system one way or another via hidden, misrepresented accounts and criminal banking behaviors similar to money launderers. After great research, it was obvious that every agency wanted to have accountability and transparency from the industry, but legislation was not supportive of such.

Safe Harbor, based upon their research determined that it was the right thing to do to protect the financial system from criminal activity and provide legitimacy to the legal operators at the same time. A high-level compliance program was created at the highest level of the organization; using decades of regulatory experience to create a safe and sound program that would accomplish industry accountability and protect the financial system. The program encompassed all types of cannabis, hemp, CBD and ancillary service providing entities to include cultivators, retailer, manufacturers, payroll companies, payment processors and professionals serving and taking cash from the industry.

Since inception, Safe Harbor has processed over $12 billion in cannabis related funds into the financial system with the highest level of monitoring and validation. SHF has successfully completed 16 state and federal exams without interruption to providing reliable financial services. The Safe Harbor portfolio is composed of nearly 600 accounts; managed by 13 private bankers. The portfolio was built in a methodical manner to ensure continuity of service while under great regulatory scrutiny. Annual deposits/cash flow in 2021 were approximately $4 billion. Safe Harbor has enjoyed a great track record of securing and retaining clients with their existing value proposition. The process of obtaining an account is difficult due to BSA regulatory requirements; making for a good long-term relationship.”

_______________________________________________________________________________________

Disclaimers Cannabis and Marijuana are illegal under federal law, The Controlled Substances Act regulates, among other things, the cultivation, possession and distribution of certain controlled substances, including Cannabis and Marijuana. This is true whether or not it is possessed for qualifying medical conditions, as provided for in certain state medical marijuana laws or if it is possessed within the few states that permit non-medicinal Adult (Recreational) Use. Marijuana is also illegal under the law of many states. There is nothing in this report written to offer any legal advice or to suggest any actions or choices the reader may make regarding participation in this industry or in any of the businesses discussed. Terms and Conditions. The materials in this report including, without limitation, informational materials and all other issuer-specific information (collectively, “Research”), have been prepared for distribution to only qualified institutional or professional clients. The content of any Research represents the views, opinions, and analyses of its authors and does not constitute financial, legal, tax or any other advice. All third party data presented therein is obtained from publicly available sources which is believed to be reliable; however, the Company makes no warranty, express or implied, concerning the accuracy or completeness of the content of such information. In no event shall the Company be responsible or liable for the correctness of, or update to, any such material or for any damage or lost opportunities resulting from use of this data. Independence of Research. GreenWave Advisors LLC is an independent research provider. The Company is not a member of the FINRA or the SIPC and is not a registered broker dealer or investment adviser. The Company has no other regulated or unregulated business activities which conflict with its provision of independent research. No employee or member of GreenWave Advisors LLC, or immediate family member thereof, exercises investment discretion over, or holds any position in, securities of any issuer analyzed by the Company

Nothing contained in this report or any distribution by GreenWave Advisors LLC should be construed as any offer to sell, or any solicitation of an offer to buy, any security or investment. Any research or other material received should not be construed as individualized investment advice. Investment decisions should be made as part of an overall portfolio strategy and you should consult with a professional financial advisor, legal and tax advisor prior to making any investment decision. GreenWave Advisors LLC shall not be liable for any direct or indirect, incidental or consequential loss or damage (including loss of profits, revenue or goodwill) arising from any investment decisions based on information or research obtained from the Company. Any opinions or estimates given may change. GreenWave Advisors, LLC undertakes no obligation to provide recipients with any additional information or any update to or any corrections of the information contained herein. GreenWave Advisors, LLC, its owners, officers, employees, affiliates and partners shall not be liable to any person in any way whatsoever for any losses, costs or claims howsoever arising from any information contained herein or any inaccuracies or omissions in the information contained herein or any reliance on that information. Reproduction and Distribution Strictly Prohibited. The research reports are produced for the exclusive use clients of GreenWave Advisors LLC. No user of the research reports may reproduce, modify, copy, distribute, sell, resell, transmit, transfer, license, assign or publish the research report itself or any information contained therein. Copyrights, Trademarks, Intellectual Property. GreenWave Advisors LLC, and the logos and marks included on the GreenWave Advisors LLC website that identifies GreenWave Advisors LLC services and products are proprietary materials. The use of such terms and logos and marks without the express written consent of GreenWave Advisors LLC is strictly prohibited.

Copyright © 2022 GreenWave Advisors, LLC , All rights reserved.

- Northern Lights Acquisition Corp (NLIT) extended the closing of its business combination with Safe Harbor Financial to July 29th (but could go to August 31st ) as the company waits for regulatory approval. An extension is not uncommon (i.e. last year, Subversive Acquisition LP / InterCure approved 4/6, extended to 8/31 closed 4/23; 9/1 shares began trading) and note that each deal’s structure is unique with varying complexities — “one size does not fit all”.

- NLIT made provisions for a redemption backstop of up to $50M via Forward Purchase Agreement (FPA) for an OTC Equity Prepaid Forward Transaction with Midtown East Management NL LLC (Midtown); Midtown. This translates to just under 5M shares ($10.21/ share).

- Midtown entered into assignment and novation agreements with Verdun Investments LLC (Verdun) and Vellar Opportunity Fund SPV LLC1 Vellar), pursuant to which Midtown assigned 1,666,666 shares to both Verdun and Vellar.

- Redemptions were 95% (~$122M) ; 63% net of ~ 3.8M FPA shares purchased (~ $38M). Net reduction to NILT’s cash balance ~$84M. It appears NILT will meet the required ~$5M in net tangible assets required for the deal to close.

Table 1: Redemption Analysis

As shown in the chart below, redemption rates have risen since the beginning of the year. Cannabis SPACs in particular have faired worse this year (e.g. Tuatara/SpringBig also ~95% redemption) likely due to the added uncertainties around federal legalization.

Table 2: SPAC Redemptions

As illustrated below, cannabis SPAC targets have on average a valued of 3.0x the IPO proceeds (amount in trust). Currently, there is a pipeline of ~$880 M which implies ~$2.6B in deal value which may prove difficult to complete, given the current envirornment.

Table 3: Cannabis SPACs

To better understand this transaction we reviewed NILT’s SEC disclosures:

June 17th : Announced “redemption backstop of up to $50M via Forward Purchase Agreement (FPA) for an OTC Equity Prepaid Forward Transaction with Midtown East Management NL LLC (Midtown). This translates to just under 5M shares ($10.21/ share).

The FPA helps ensure the maximum redemption threshold will be met, increasing the likelihood that the transaction will close. Typically how this would work is the day after SHF becomes a publicly traded entity, it would reimburse Midtown and Atalya for the purchase price of the shares. If SHL stock increases, the Midtown East can sell its shares and keep the profit.

June 22nd : 11,416,205 shares redeemed; ~95% of the 12,028,175 Class A shares.

June 27th: Midtown East, Verdun and Vellar purchased 1,599,496, 1,180,376 and 1,025,000 shares at an average purchase price per share of $10.21 (3.8M).

June 29th: Boothbay sold its 3.9M shares – Form 4 Filed = $39M on the open market.

July 7th : Form 3 filed (Initial Statement of Beneficial Ownership of Securities) with the SEC naming Atalaya Special Purpose Investment Fund II LP and Atalaya Capital Management LP as beneficial owners along with Midtown East. Atalaya is an alternative asset manager and has been active in the space.

_________________________________________________________________________

Safe Harbor Financial

The company’s investment thesis (see investor deck):

- Leading Provider of Cannabis Related Financial Services in the US

- Unique low cost of capital lending

- Deep expertise in building complaint banking and Financial solutions for CRBs

- Platform to consolidate highly fragmented cannabis financial services industry

- Team with the knowledge and experience to execute on strategy

We note that In 2017, we published “Navigating the Shoals of Cannabis Banking” in which we highlighted Partner Colorado Credit Union and Safe Harbor. The following has seemingly come to fruition (longer term viability and concentration risk mitigated with expansion into additional states):

“We believe that until such time as the federal government ends prohibition or passes legislation to change existing laws that the cannabis industry will be impelled to seek out temporary solutions to facilitate banking transactions. It is hoped that some of these work-arounds will be suited for longer term viability and will (or continue to) stand the tests of regulatory scrutiny.”

While we recognize the apparent efficacy and viability of PCCU’s model and its Safe Harbor platform we also make note that such a large concentration of sector business being housed with a single institution may represent an inherent risk management hurdle for some investors. This concentration risk will likely be alleviated as PCCU (as well as other firms providing similar services) continues its success in licensing or otherwise propagating its Safe Harbor platform to additional credit unions or financial services entities.”

Safe Harbor Financial was conceived in 2015 as a solution to a major problem that plagued the nascent legalized cannabis industry in Colorado– access to reliable and compliant financial services. Once SHF addressed the local Colorado issues surrounding lack of banking and industry participants became banked, clients started seeking out of state licenses; leading SHF to a national presence and the establishment of a national foundation that enabled SHF to solve the same issues on a national level. As a result, Safe Harbor presently processes funds from 20 different states nationally.

Safe Harbor, realizing the funds from the cannabis industry were better banked than unbanked, ventured forward to do the right thing for everyone, bank the deposits under Partner Colorado Credit Union as a DBA up until 2021. Cannabis related funds were already finding their way into the financial system one way or another via hidden, misrepresented accounts and criminal banking behaviors similar to money launderers. After great research, it was obvious that every agency wanted to have accountability and transparency from the industry, but legislation was not supportive of such.

Safe Harbor, based upon their research determined that it was the right thing to do to protect the financial system from criminal activity and provide legitimacy to the legal operators at the same time. A high-level compliance program was created at the highest level of the organization; using decades of regulatory experience to create a safe and sound program that would accomplish industry accountability and protect the financial system. The program encompassed all types of cannabis, hemp, CBD and ancillary service providing entities to include cultivators, retailer, manufacturers, payroll companies, payment processors and professionals serving and taking cash from the industry.

Since inception, Safe Harbor has processed over $12 billion in cannabis related funds into the financial system with the highest level of monitoring and validation. SHF has successfully completed 16 state and federal exams without interruption to providing reliable financial services. The Safe Harbor portfolio is composed of nearly 600 accounts; managed by 13 private bankers. The portfolio was built in a methodical manner to ensure continuity of service while under great regulatory scrutiny. Annual deposits/cash flow in 2021 were approximately $4 billion. Safe Harbor has enjoyed a great track record of securing and retaining clients with their existing value proposition. The process of obtaining an account is difficult due to BSA regulatory requirements; making for a good long-term relationship.”

Source: Safe Harbor Financial

THE OPPORTUNITY

The company’s investment thesis (see investor deck):

- Leading Provider of Cannabis Related Financial Services in the US

- Unique low cost of capital lending

- Deep expertise in building complaint banking and Financial solutions for CRBs

- Platform to consolidate highly fragmented cannabis financial services industry

- Team with the knowledge and experience to execute on strategy

We note that In 2017, we published “Navigating the Shoals of Cannabis Banking” in which we highlighted Partner Colorado Credit Union and Safe Harbor. The following has seemingly come to fruition (longer term viability and concentration risk mitigated with expansion into additional states):

“We believe that until such time as the federal government ends prohibition or passes legislation to change existing laws that the cannabis industry will be impelled to seek out temporary solutions to facilitate banking transactions. It is hoped that some of these work-arounds will be suited for longer term viability and will (or continue to) stand the tests of regulatory scrutiny.”

While we recognize the apparent efficacy and viability of PCCU’s model and its Safe Harbor platform we also make note that such a large concentration of sector business being housed with a single institution may represent an inherent risk management hurdle for some investors. This concentration risk will likely be alleviated as PCCU (as well as other firms providing similar services) continues its success in licensing or otherwise propagating its Safe Harbor platform to additional credit unions or financial services entities.”

Disclaimers Cannabis and Marijuana are illegal under federal law, The Controlled Substances Act regulates, among other things, the cultivation, possession and distribution of certain controlled substances, including Cannabis and Marijuana. This is true whether or not it is possessed for qualifying medical conditions, as provided for in certain state medical marijuana laws or if it is possessed within the few states that permit non-medicinal Adult (Recreational) Use. Marijuana is also illegal under the law of many states. There is nothing in this report written to offer any legal advice or to suggest any actions or choices the reader may make regarding participation in this industry or in any of the businesses discussed. Terms and Conditions. The materials in this report including, without limitation, informational materials and all other issuer-specific information (collectively, “Research”), have been prepared for distribution to only qualified institutional or professional clients. The content of any Research represents the views, opinions, and analyses of its authors and does not constitute financial, legal, tax or any other advice. All third party data presented therein is obtained from publicly available sources which is believed to be reliable; however, the Company makes no warranty, express or implied, concerning the accuracy or completeness of the content of such information. In no event shall the Company be responsible or liable for the correctness of, or update to, any such material or for any damage or lost opportunities resulting from use of this data. Independence of Research. GreenWave Advisors LLC is an independent research provider. The Company is not a member of the FINRA or the SIPC and is not a registered broker dealer or investment adviser. The Company has no other regulated or unregulated business activities which conflict with its provision of independent research. No employee or member of GreenWave Advisors LLC, or immediate family member thereof, exercises investment discretion over, or holds any position in, securities of any issuer analyzed by the Company

Nothing contained in this report or any distribution by GreenWave Advisors LLC should be construed as any offer to sell, or any solicitation of an offer to buy, any security or investment. Any research or other material received should not be construed as individualized investment advice. Investment decisions should be made as part of an overall portfolio strategy and you should consult with a professional financial advisor, legal and tax advisor prior to making any investment decision. GreenWave Advisors LLC shall not be liable for any direct or indirect, incidental or consequential loss or damage (including loss of profits, revenue or goodwill) arising from any investment decisions based on information or research obtained from the Company. Any opinions or estimates given may change. GreenWave Advisors, LLC undertakes no obligation to provide recipients with any additional information or any update to or any corrections of the information contained herein. GreenWave Advisors, LLC, its owners, officers, employees, affiliates and partners shall not be liable to any person in any way whatsoever for any losses, costs or claims howsoever arising from any information contained herein or any inaccuracies or omissions in the information contained herein or any reliance on that information. Reproduction and Distribution Strictly Prohibited. The research reports are produced for the exclusive use clients of GreenWave Advisors LLC. No user of the research reports may reproduce, modify, copy, distribute, sell, resell, transmit, transfer, license, assign or publish the research report itself or any information contained therein. Copyrights, Trademarks, Intellectual Property. GreenWave Advisors LLC, and the logos and marks included on the GreenWave Advisors LLC website that identifies GreenWave Advisors LLC services and products are proprietary materials. The use of such terms and logos and marks without the express written consent of GreenWave Advisors LLC is strictly prohibited.

Copyright © 2022 GreenWave Advisors, LLC , All rights reserved.