- Herbl, one of California’s largest licensed cannabis distributors is in receivership. Last year it served ~1K retailers and accounted for ~18% (~$700M) of the state’s $3.8B retail sales amount. Other licensees could be at or near a similar breaking point.

- California is the largest cannabis market in the U.S. which at maturity, we estimate at ~$7B.

- The state’s accounting of delinquent excise and cultivation taxes that are due from distributors totals ~$200M (~$400M with interest and penalties). This translates into a wholesale value of ~$539M which likely represents the amounts owed to product manufacturers (brands). According to the California Department of Tax and Fee Administration (CDTFA), there are 327 distributors with delinquent tax accounts (~30% of the total).

- With nearly $1B owed ($400M taxes/penalties, $539M inventory), many brands (as well as retailers) could be forced out of business or will need to consolidate. Our estimates do not include amounts owed to vendors or service providers.

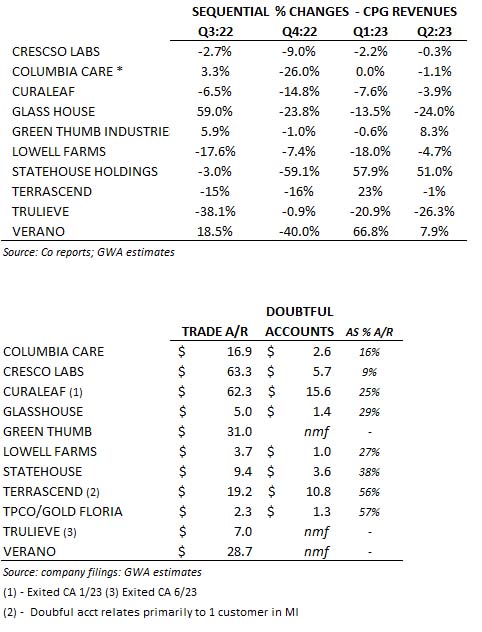

- The impact to Single State Operators (SSO) and the larger MSOs with exposure to the California market appears negligible, and many have implemented tighter credit policies to mitigate potential losses. This is evidenced to some extent by sequential declines in wholesale (CPG) revenues. Also, many have either exited the state or have downsized operations.

- As the California market continues to evolve by trial and error, ineffective and non-sensical policies have been called to question. Regulators seemingly are moving towards a more balanced, practical approach to sync effective regulatory oversight with sound business acumen. We believe this re-set will, in time, attract new capital into the California cannabis market.

Full Article

Background

California passed a ballot initiative in 2016 to legalize recreational use marijuana alongside an existing medical market that had been unregulated since 1996. In 2015, a licensing and regulatory system for medical marijuana was enacted but in 2017, in anticipation of a new recreational market (Jan 2018) regulatory oversight shifted to one agency. California is the largest cannabis market in the U.S. which at maturity, could reach ~$7B.

Early on, many suppliers in California obtained distribution licenses to only realize in short order that the cash burn made a tough operating environment even more difficult. Many of these licenses were sold and today there are hundreds of burner distributors able to buy product from licensed suppliers and sell into the illicit market.

Serving as the middleman, distributors take possession of inventory from a manufacturer (or cultivator) and make delivery to the retailer. The distributor collects money from the retailer, deducts a fee, and then pays the supplier. Collections have not been COD, but in general net 30 (in some cases, much longer). Up until 1/1/2023, the distributor was responsible for collecting excise tax from retailers (cultivation tax from the grower) and filing the tax returns – the retailer now bears that responsibility. (cultivation tax was eliminated 7/1/22).

This illustrates the flow of tax collections and payments:

The hope for a distribution oligopoly could be one reason for the distributor requirement. In 2017 when lawmakers began thinking about how the industry could be regulated, there was not a “best practices” model to start from. We are not privy to the inner circles of California politics and for obvious reasons we are not in a position to gauge the rationale behind any regulatory decisions.

However, we recall two individuals that formed an entity in 2017 to help design Trailer Bill legislation to govern California’s cannabis supply chain. One of which is a former California Attorney General that had also served as a legislator in both the Assembly and the Senate. This entity obtained a distribution license but failed to raise sufficient levels of capital to support this business. This license expired in 2019.

Herbl, one of California’s largest licensed cannabis distributors is in receivership which accounted for ~18% of the state’s retail sales total. As retailers (dispensaries) remain pressured from a thriving illicit market, price compression, mounting operating losses compounded by an onerous tax burden (280E), amounts owed to these distributors have remained unpaid. Consequently, the domino effect has left many brands in limbo and the related excise and cultivation tax collections are owed to the CDTFA.

The amount owed by distributors for back taxes (excl. interest and penalties) and inventory is ~$738M According to the CDTFA, delinquent cultivation and excise taxes totaled ~$200M (as of July 31); with penalties and interest the amount has reached ~ $395M.

We estimate the amount owed to the manufactures (brands) totals ~$534M based on the following assumptions:

- The proportionate share of excise tax used in this calculation is commensurate with the amounts reported by the State’s cannabis data portal (separate excise and cultivation tax line items).

- If taxes are past due, then we assume payments to brands have also not been paid.

- We assume there is a 50% markup on retail sales (Wholesale= (excise tax/15%)*50%).

We acknowledge that this is just an estimate – the calculated wholesale value could be more or maybe less.

As the table indicates, there remains ~ $738M in monies owed for product and taxes. While many retailers have held back payment to the distributors, it is possible that some distributors have made timely collections from a retailer but without remuneration to the brand (in effect, have used these funds as a source of capital).

As noted below, we estimate that only ~5% to~ 8% of total retail sales remain unpaid. The CDTFA indicates that on average 94% of total taxes reported on cannabis have been paid, which is, by and large, consistent with our calculation.

As a reminder, there has been widespread misinterpretation of California retail sales which we have previously reported on (see “Stirring the Pot in California – Cannabis Sales Overstated by $6 Billion (2018-2022” ; our analysis is predicated on these lower sales figures.

The read-through – Minimal Impact on the larger Multi-State Operators and Single-State Operators. There are over 1.1K active distributors and 1.2K commercial retailers in California, most of which are privately held. For those that are publicly traded, there are just a handful of Single-State Operators. We identified those Multi-State Operators with operations in California over the past four quarters; the extent of exposure for each of these companies is unknown because state specific data is not disclosed. Also, we have not captured every publicly traded company in this exercise because we believe our selection is representative of the current trends in California.

As the table indicates, most of these operators have experienced sequential declines in CPG revenues over the past few quarters. This is due in part to the implementation of tighter credit policies and/or other proactive measures to mitigate potential losses.

A few other data points:

Glasshouse

On its Q2 earnings call indicated, “We had expected negative sequential growth in our CPG wholesale sales in the second quarter due to the financial difficulties of HERBL, one of the state’s largest distributors, along with the challenges facing all brands in the current California marketplace. One of the main struggles for CPG in California is the difficulty in collecting receivables as many retailers themselves are in dire financial straits.”

Cresco Labs

In Jan 2020, Cresco Labs closed its $800M acquisition of Origin House, a leading wholesale distributor in California, which at that time sold into “over 575 dispensaries, representing approximately 65% of California’s storefront dispensaries.”

Origin House distributed to Kings Garden which defaulted on a $2.3 million monthly lease payment to Innovative Industrial Properties on its Southern California properties. Accordingly, we think it reasonable to assume that Kings Garden is just one example of a brand that was probably not paid.