KEY POINTS:

- For over a decade, since the “Colorado experiment” in 2014, the Federal Government has maintained its prohibitive legal status of marijuana. Still, the pressures brought to bear by the multitude of state statutes that have locally decriminalized and regulated marijuana have gradually comforted business development.

- This has led to an ~ $40 billion industry (estimate by year end) that could reach well over $100 billion at maturity; Capital expenditures are in the billions of dollars, and the materialized economic benefits can no longer be ignored.

- Capital remains scarce, and the ability to continue as a going concern is a real issue for many cannabis enterprises. Most have halted payment of taxes associated with IRS Code Section 280E and seek refunds for past remittances. With few exceptions, most are unable to generate sufficient operating cash flow because of the ongoing headwinds of federal prohibition.

- Given the progression of new state markets over the past decade, it is unsurprising that we now stand on the cusp of a meaningful change to federal policy (with Schedule III). We would expect a new pro-cannabis Trump administration to expedite the process with a common sense business approach that recognizes the immediate need to eliminate the 280E burden through rescheduling (a meaningful first step). Failure is not the outcome that was likely envisioned when this movement to legalize cannabis began over a decade ago.

Full Article

Federal Cannabis reform efforts have been predicated on the progression of regulated state markets.

Over the past decade, the steady progression of individual state reform has led to the legalization of medical marijuana in 39 states (plus DC), of which 24 (plus DC) allow recreational use. Significant economic benefits have materialized in the form of tax revenues and jobs.

“The overall growth in the US legal marijuana industry is substantial and will be fueled by the implementation of additional legalized markets across the country as momentum continues in favor of changes to existing federal laws.

What is driving the growth is that the medical benefits of marijuana are becoming better understood and that politicians are becoming more mindful of the positive economic impact of legalization. Perhaps most importantly, public support in favor of legalization is growing.” The GreenWave Report, 2014

Although the Federal Government has continued to maintain marijuana’s prohibitive legal status, the pressures brought to bear by the multitude of state statutes that have locally decriminalized and regulated marijuana have gradually comforted business development within the industry. This has led to an approximate $40 billion industry estimated by the end of 2024. We expect the market to be well over $100 billion at maturity.

We are at an Infection Point

In October 2022, right before the mid-term election, President Biden directed the Secretary of Health and Human Services (HHS) and the Attorney General to “conduct a scientific review of how marijuana is scheduled under federal law. After receiving HHS’s recommendations last August, the Attorney General sought the legal advice of the Justice Department’s Office of Legal Counsel (OLC) on questions relevant to this rulemaking. In light of HHS’ medical and scientific determinations and OLC’s legal advice, the Attorney General exercised his authority to initiate the rulemaking process to transfer marijuana to schedule III.” DoJ May 2024

Trump Administration

The dichotomy between state and federal laws spans five Presidential administrations (six if we include Trump’s next term), and with every new administration, there is an element of uncertainty, particularly noteworthy in the early years of the industry’s evolution.

Given the progression of new state markets and the economic benefits that have materialized over the past decade, it is unsurprising that we now stand on the cusp of a meaningful change to federal policy (with Schedule III).

One Step Back, Many Steps Forward

During the first Trump administration, AG Jeff Sessions rescinded the Obama Administration’s guidance on Marijuana business activities (Cole Memorandum), which caused some near-term concern for investment and growth potential within the industry.

As we soon learned, this attempt had no impact on law enforcement. State markets continued to proliferate. The only negative consequence centered on the overly cautious sentiment among financial institutions that pulled the plug on custody and clearing services.

Nonetheless, this action created a heightened level of ambiguity concerning the federal government’s tolerance for marijuana businesses to continue operations under state laws that conflict with the federal guidelines. However, in light of the cultural, economic, and political advances in marijuana acceptance and desirability by a majority of Americans, this aggressive attempt by Mr. Sessions to move the country backward served no purpose.

A Common Sense Approach

Before the election, many maintained the view that a new Trump AG would oppose the advancement of cannabis reform. Now, with an apparent pro-cannabis cabinet that potentially includes Matt Gaetz as AG, it seems nonsensical to prolong the rescheduling process, particularly as many cannabis companies are on the brink of failure. This is not the outcome that was likely envisioned when this movement began over a decade ago.

“We do not believe the federal government would take such unprecedented actions without it carefully considering the long-term benefits derived from marijuana legalization. In addition to favorable economics, marijuana is proving to provide considerable practical use for many patients suffering from a wide variety of ailments and conditions. In our opinion, to “dangle a carrot” and then take it away makes no sense, and we highly doubt such action will be forthcoming.” The GreenWave Report 2014

The Industry is too Big to Fail – It is time to think Dollars and (common) Sense.

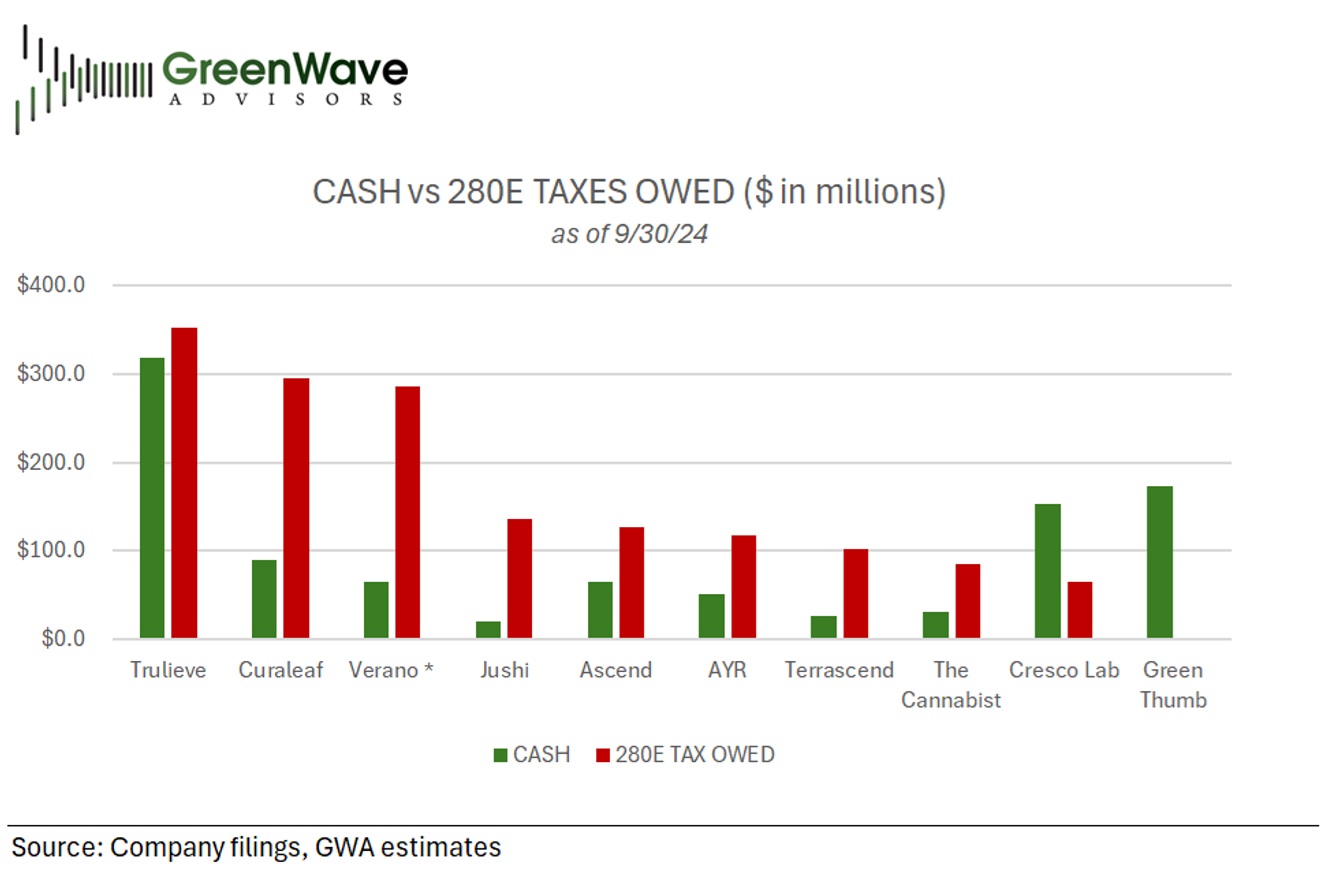

Cannabis companies are taxed on gross profit, not pre-tax income. Most cannabis companies report pre-tax losses, so they need to raise capital just to satisfy tax obligations. In those rare instances where pre-tax income is reported, roughly 70-80% of the operating cash flow is drawn.

Last year, Trulieve revealed it adopted a tax position challenging the applicability of 280E. As such, it filed amended returns for the tax years 2019 through 2021 totaling $143 million—to date, it has received $113 million. Starting in 2022, it began filing as a typical corporate taxpayer, resulting in overpayment claims of $148 million.

For GAAP purposes, the company continues to accrue its 280E obligation, but rather than classifying this liability as short-term, it is recorded as an Uncertain Tax Position (long-term).

Other operators have followed Trulieve’s lead and continue to withhold payment even though the IRS recently issued a bulletin affirming 280E remains applicable for cannabis businesses. This may prove a more sensible path as a cheaper alternative to traditional financing (assuming penalties are waived).

Several leading MSOs have retained high-profile attorney David Boies to challenge the constitutionality of the Controlled Substances Act for intrastate cannabis and the applicability of 280E. This litigation could take years to resolve.

For more on this topic, see the GreenWave Buzz: “More 280E Refund Claims Headed to the IRS “Joint” Committee—Does One Size Fit All?“

In the meantime, many operators do not have the liquidity to satisfy these obligations.

The Snake in the Grass

I’ve cautioned investors to beware of the snake in the “grass,” referring to 280E tax audits by the IRS. Ascend Wellness Holdings disclosed in Q3 it has been selected to examine its amended tax returns and Uncertain Tax Position.

Additionally, the IRS has knocked on a few other cannabis doors, indicating its intentions to examine amended returns that seek refunds for past 280E payments. Given the IRS’s recent publication (see above), which affirms the applicability of 280E as it relates to cannabis businesses, it seems likely the IRS will reject these efforts. What could come out of these examinations is a review of specific 280E methodologies and calculations. Since financial statements have been restated on numerous occasions by several MSOs, it would not be surprising if the IRS notes deficiencies in these calculations– but maybe not.

Schedule III

Rescheduling is likely a prelude to scheduling, which could take years because, upon Schedule III, federal regulators will be able/willing to better understand issues around product safety and determine how best to regulate at the federal level. RFK Jr., Trump’s pick to head the HHS, could be instrumental in moving this forward.

The reclassification will eliminate the 280E tax burden, materially improving cash flows and unlocking shareholder value quickly. Rescheduling also eliminates a critical element of risk and uncertainty that has kept some institutional investors on the sidelines.

Other points:

- There are still many complexities and unknowns, but for now, individual state rights will likely remain status quo while still operating under the shadow of federal law. We expect updated guidance from the DoJ upon a final ruling to clarify any ambiguities.

- Active and unrestricted capital market access is needed to maximize potential economic (and social) benefits. Safe Harbor provisions for banks and SEC-regulated activities (investment banking, custody, stock exchanges, etc.) remain in question, but the potential for economic growth is significant and promising.

- With a rescheduling, updated FinCen (US Treasury Department) that includes such protections may suffice without specific legislation (such as SAFER Banking).

- In the meantime, Schedule III designation will expand permissions for research, likely fostering the bringing to market of new cannabinoid-based products, which is an exciting prospect for the industry’s future, presumably under the umbrella of FDA oversight.

- The rescheduling could also mark a significant step towards industry normalization that will inspire an ‘uplift’ of professional pedigree, which will propel the industry further and eliminate the stigma associated with cannabis, a promising development for the industry.