Key Points:

- U.S. Cannabis revenue growth hinges significantly on the emergence of new state markets.

Ohio, for instance, is set to kick off its recreational sales next month, a move that could

potentially be replicated in Florida (through a ballot initiative) and Pennsylvania (via a legislative

measure). - There has been a steady decline in medical marijuana cardholder counts (and revenues) in

states that have legalized recreational use (cardholders, in turn, become consumers of a rec

market). - Based upon an analysis of average spending trends in several Medical Marijuana markets, we

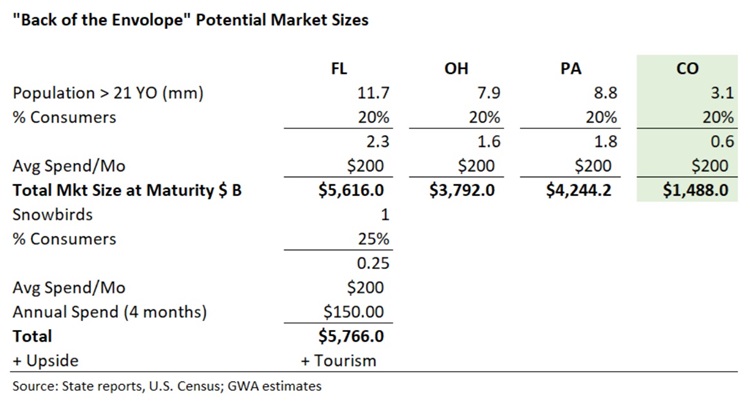

estimate, conservatively, a potential of $3.8B for Ohio; Florida, and Pennsylvania, $5.6B, and

$4.2B, respectively. - For a sense of reasonableness, we applied the same methodology and assumptions to the

Colorado market, established ten years ago for all intent and purposes. This exercise revealed ~

$1.5B, which approximates today's market. - Consensus revenue estimates over the next five years (and likely current valuations of publicly

traded operators) do not include the incremental lift from these new markets. - The timing of a complete rollout is unknown and, as we have learned over the years, difficult to

predict.

Full Article

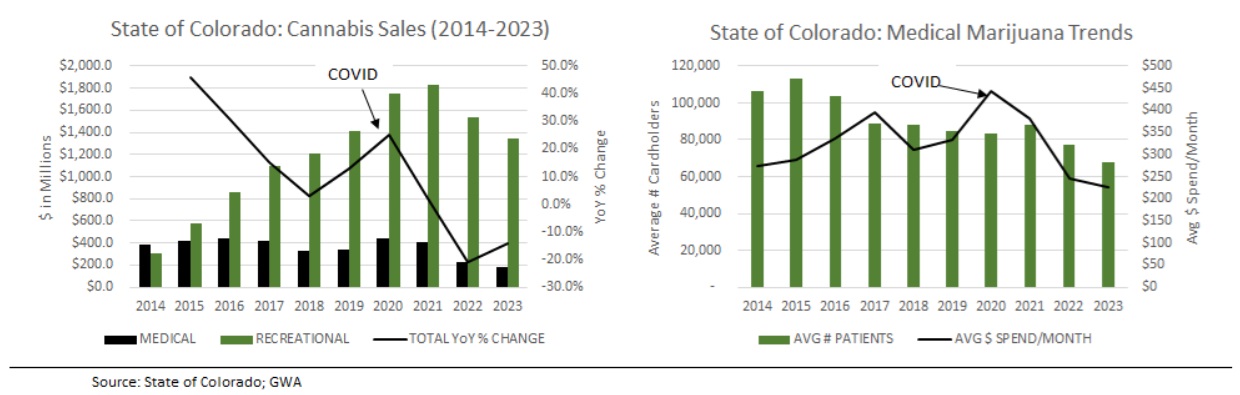

Over the past ten years, we observed a steady decline in medical marijuana cardholder counts (and revenues) in states that have legalized recreational use. This disruption comes from several factors

abetting the recreational use market, including convenience in terms of proximity, ease of use in the sense that a doctor’s recommendation is not necessary, and assurance of confidentiality (as there is no registry requirement).

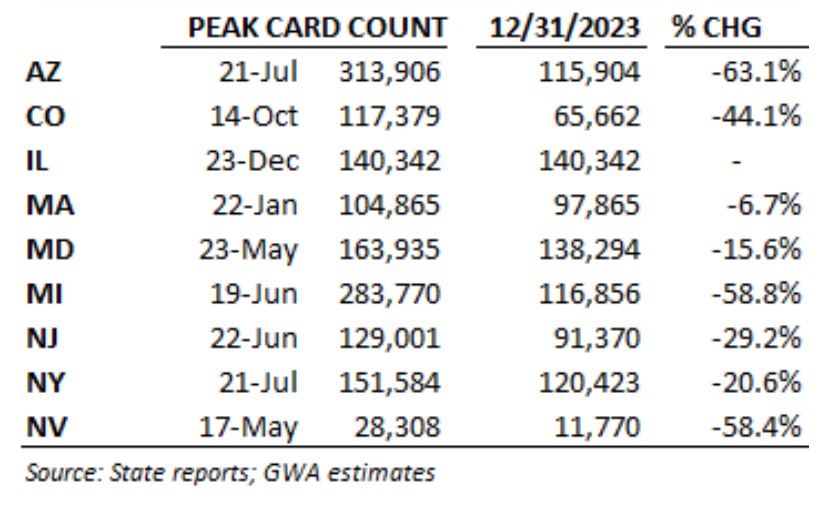

The following illustrates the impact recreational use has had on several existing medical markets:

The narrative in our inaugural GreenWave Report (2014), remains relevant:

- “Since “chronic pain” (loosely defined), is the most common ailment among medical marijuana users, it is likely that a number of recreational users are already purchasing marijuana without great difficulty in states where medicinal use is legal.”

- “The availability of the recreational marketplace may become increasingly more appealing to the current medicinal user and that the disruption to current fundamentals will ultimately lead to a combined medical and recreational market at some point in the future.”

- “The easing of recreational use restrictions has disrupted the growth rate of the presently constituted medical marijuana market. That said, we believe that the medicinal use market will recalibrate when the pipeline of new, more targeted medications become available and as the medical profession gains more comfort in “pushing” a marijuana treatment rather than a patient having to “pull” a recommendation from a doctor.” This is becoming more evident with the reclassification to Schedule III.

Given this, it is reasonable to assume that the average monthly cardholder spending could serve as a proxy for an approximate recreational use spending level. We calculated this metric in several key existing medical markets, including Ohio, Florida, and Pennsylvania.

Note: Avg spend/month calculation is likely understated because not all cardholders make purchases in any given month

therefore the denominator (patient count) is smaller hence average spend is higher.

This analysis has determined a “back of the envelope” potential market size for these three markets.

Assumptions:

- 20% of the state’s population over the age of 21 consume cannabis.

- Approximate average spend per month of $200 (reasonable based upon average spend analysis)

- ~ 1 million people have a second residence in FL and spend 4 months a year and spend $150/month.

For a sense of reasonableness, we applied the same methodology and assumptions to the Colorado market, established ten years ago for all intent and purposes. This exercise revealed ~ $1.5B, which approximates today’s market.