Key Points:

- Trulieve’s recent $113 million refund has prompted other operators to reevaluate their past and future strategies as the punitive 280E tax continues to wreak havoc on the Cannabis industry.

- We hosted a webinar discussion to help investors better understand the Internal Revenue Service (IRS) process and position. The debate featured a partner from CohnReznick and an Attorney and partner with SunBank Legal, who, while serving at the DoJ, litigated cases involving constitutional challenges to federal law treatment of the cannabis industry (280E).

- There are compelling arguments to repeal 280E (consistent with the Boies Schiller case); however, the Trulieve refund does not set a precedent for other operators.

- It is unclear whether the refund was issued erroneously or subject to review by the IRS Joint Committee on Taxation (standard procedure). Truelieve acknowledges that it may be required to remit the funds back to the IRS.

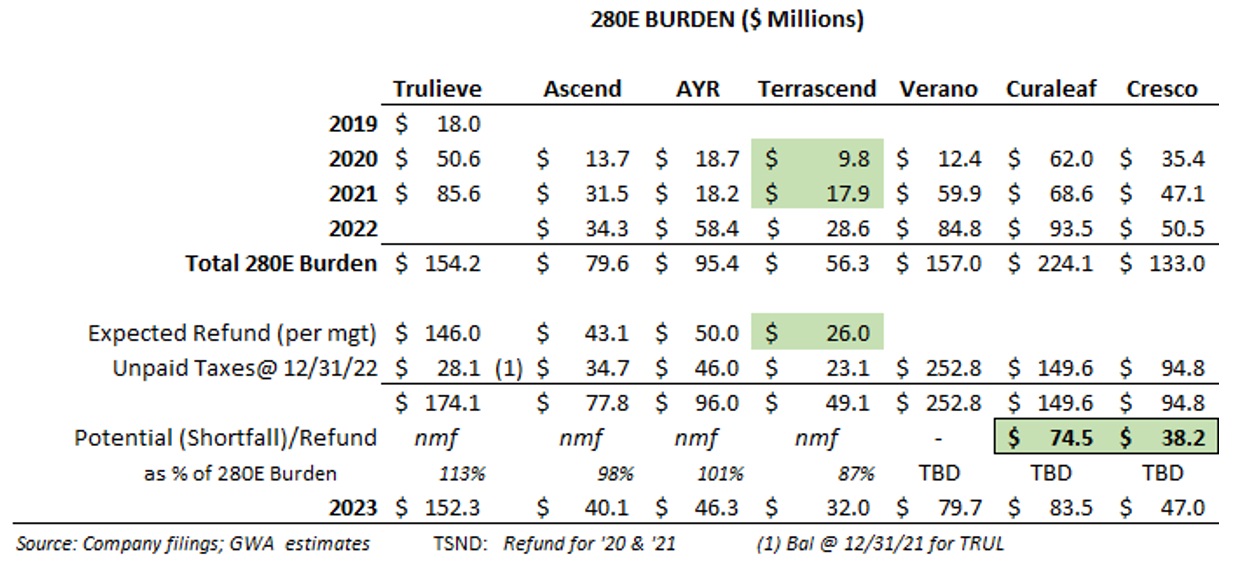

- Curaleaf and Cresco Labs have yet to disclose their potential refunds, which could reach ~$75M and ~$38M, respectively based upon our estimates. Others will likely follow.

- 280E collections have brought billions of dollars to the U.S. Treasury, about 5-7% of cannabis retail revenues (per our estimates). Hypothetically, an industry-wide 280E refund (or savings) from 2020 – 2023 could total ~$5.8B. Considering the U.S. budget deficit is in the trillions, these lost revenues could influence the outcome.

- A retroactive repeal of 280E could trigger significant Net Operating Loss (NOL) carryforwards at the Federal level (and in states that have not decoupled 280E).

Full Article

Ridding the “Snake” (280E) in the Grass

We have previously expressed concerns that the ongoing federal prohibition of cannabis could make it difficult for many cannabis operators to continue as a going concern. The added costs of prohibition, most notably the punitive tax burden associated with IRS Section 280E, continue to wreak havoc on the Cannabis industry, which has prompted a re-evaluation of past and future tax payments and strategies.

The following grid illustrates the impact of 280E on operating cash flows. As noted, for Tier 1, Green Thumb, Verano, and Trulieve remain self-funded, and MariMed is the Tier 2 outlier. Essentially, all others (red or grey) have had to raise capital to fully or partially satisfy current tax obligations.

Last year, on its Q3 conference call, Trulieve disclosed that it is challenging the applicability of 280E and filed amended tax returns for the years 2019 – 2021, seeking a refund totaling ~$ $143 million. To date, ~ $ $113 million has been recovered.

Not surprisingly, other operators have followed suit. TerrAscend announced it expects a refund of $26M for 2020 -2022. Ascend Wellness expects to recover an amount for the same period equal to its 2023 tax provision of $ 42M (according to our estimate).

In some instances, (Ascend, TerrAscend, Ayr) the expected refund is limited to what has been paid vs the total liability (2020-2022).

The following provides a reconciliation of the 280E burden and the refund claims. Based upon our analysis, Curaleaf and Cresco Labs could receive refunds for ~$75M and ~$38M, respectively.

To help better understand the Internal Revenue Service (IRS) process and position, we hosted a webinar discussion with Michael Harlow, Parter–CohnReznick, and Nate Pollock, Partner at SouthBank Legal. Nate heads its Tax Controversy Practice and has also gained experience at the DoJ in its Tax Division. He has litigated tax cases involving various issues, including constitutional challenges to tax laws and federal law treatment of the cannabis industry (Section 280E). REPLAY

Webinar Takeaways

Refund Process through The Joint Committee

Trulieve’s refund surprised both Michael and Nate (and the accounting/legal communities in general) and emphasized that a similar outcome is not guaranteed, as each operator has a unique situation, and one size does not fit all. While Nate believes there is a solid argument to remove 280E, he does not expect the IRS to accept it.

In the normal course of business, a refund greater than $5 million is reviewed by the IRS Joint Committee (JC) on Taxation before it is issued. We do not know the circumstances of Trulieve’s refund and whether it was subject to the JC examination. A JC refund case is assigned to an IRS examiner and either examined or surveyed. A survey is a decision to accept a return without an examination. Uncertainty remains (and Truelieve acknowledges this) as to whether or not the company will be required to remit the refund back to the IRS.

There are two ways in which the IRS could claw back a refund:

- In the ordinary course of an audit within the statutory time frame.

- The DoJ could file a lawsuit to recover an erroneous refund, generally within a two-year window. Nate indicated this is not the norm because it’s unlikely the government, after review by the joint committee, would issue an erroneous refund and then litigate for recovery.

Types of Refund Claims

Taxpayers have a limited time to file refund claims with the IRS. This time limit may occasionally expire before the taxpayer’s right to the refund claim is finalized and determinable (e.g., during pending litigation). The taxpayer must file a protective claim to preserve its right to claim a refund.

Some operators may use Trulieve’s refund outcome as the basis for filing a protective refund claim. As Nate points out, this presents unique challenges because the taxpayer needs to identify a specific contingency, which is not readily determinable due to several unknowns. However, he suggests that such an effort may work if several MSOs take the same position, but the scenario needs to be clarified.

Nate points out the difference between a “refund claim” and a “protective refund claim.”

Refund claim: the taxpayer indicates how much is owed with an explanation. If the reason is not good or there is a different theory after the limitations period, and the case ends up in litigation, then the taxpayer is out of luck.

Protective refund claim: the taxpayer does not take a position, and the claim serves to hold the statute open based upon an identified contingency, which is difficult because Trulieve already received the refund and the matter is not in litigation. If several MSOs take the position that 280e does not apply and that there is the possibility for litigation, then perhaps the statute could remain open – Nate indicates this strategy could work. Still, again, it’s not super clear.

Nate pointed out that the well-known, highly publicized Harborside case differs because the issues relate to the 16th Amendment. Protective Refund claim – put in harborside litigation maybe use but doesn’t think the 16th Amendment argument will prevail.

Argument Foe 280E Appeal

The Rohrabacher-Farr (RF) amendment (appropriations rider) prohibits the DoJ from spending funds to interfere with the implementation of state medical cannabis laws. Nate indicates this is legally significant and part of the basis to repeal 280E, but it doesn’t necessarily mean that it applies to Trulieve’s position.

Nate referred to his recently published article, “Medical Marijuana Companies Have a Stronger 280E Argument”, in MJBizDaily. He argues that the landmark case Gonzales vs Raich no longer applies because the RF rider has been in effect since 2015. Thus, the DoJ cannot prosecute medical marijuana businesses. The RF rider, in effect, amends the Controlled Substances Act (CSA), rendering a piece of the CSA unenforceable.

The Boise Schiller case filed last October seeks to end prohibition. In January, the DoJ filed a motion to dismiss, though the plaintiffs have filed for an appeal. Nate indicated that getting a case to the Supreme Court is very difficult.

Farm Bill Loophole

Trulieve would not provide details on its amended filing and referred to the matter as a “trade secret.” Most of Trulieve’s business is transacted in Florida, a medical-only state. Delta-8 and Delta-10 are legal in Florida due to a loophole in the 2018 farm bill (Effective Oct 1, these products are banned).

On our recent Space Jam on X (formerly known at Twitter), Lezli Engelking (FOCUS) and Chris Hudalla (ProVerde Labs) did not rule out the possibility that the sale of hemp-derived products could potentially be part of the “trade secret.” Michael’s stance is that a hemp argument is not likely.

IRS as a Source of Funding

Over the past few years, postponing tax payments has become necessary for many operators because sources of capital remain scarce.

For well-thought-out claims, there are two penalty defenses:

- The “Noticed Position” is supported on a reasonable basis. The IRS receives and reviews a tax opinion letter from an attorney. Interest is owed if taxes are unpaid, but taxpayers can fight penalties.

- The “Reasonable Cause” defense is supported by a CPA who signs the tax return.

For a refund, you can generally go back three years and file an amended return from the date filed or two years from when the last payment was made. This is particularly helpful for those on payment plans. If under audit, the deadline to file for a refund is extended to six months in most states or line with federal rules.

Will the IRS give back 280E Tax Revenues?

280E collections have brought billions of dollars to the U.S. Treasury. We estimate that the total is about 5-6% of revenues (less than our original estimate of ~10% due to more specific data points noted in regulatory filings). If we assume the IRS determines that 280E is not applicable, the potential refund /tax savings could reach ~$5.8B (assumes claims will be or have been made from 2020 – 2023). These lost revenues could factor into the IRS’s decision to refund.

Exposure from smaller firms

Industry consolidation is inevitable. It is important to have carefully prepared books and records and to take a conservative approach with 280E because when you are ready to exit, you don’t want 280E to be used to drive down a valuation.

Schedule III

With a reclassification to Schedule III, Michael concurs that there would be no differentiation between the recreational and medical use of cannabis for 280E purposes.

NOL carryforwards

Michael underscored the difficulty for a federal NOL because a negative gross margin is necessary but is applicable for some some California operator due to price compression. For state tax purposes, generally speaking, and assuming the state has decoupled 280E, NOLs could be carried forward. Additionally, should the IRS/courts rule that 280E does not apply retroactively, federal NOLs could potentially be realized.

Disclaimers

The Controlled Substances Act regulates, among other things, the cultivation, possession and distribution of certain controlled substances, including Cannabis and Marijuana which are illegal under federal law and in many states.. This is true whether or not it is possessed for qualifying medical conditions, as provided for in certain state medical marijuana laws or if it is possessed within the few states that permit non-medicinal Adult (Recreational) Use.

There is nothing in this briefing written to offer any legal advice or to suggest any actions or choices the reader may make regarding participation in this industry or in any of the businesses discussed.

Nothing contained in this report or any distribution by GreenWave Advisors LLC should be construed as any offer to sell, or any solicitation of an offer to buy, any security or investment. Any research or other material received should not be construed as individualized investment advice. Investment decisions should be made as part of an overall portfolio strategy and you should consult with a professional financial advisor, legal and tax advisor prior to making any investment decision. GreenWave Advisors LLC shall not be liable for any direct or indirect, incidental or consequential loss or damage (including loss of profits, revenue or goodwill) arising from any investment decisions based on information or research obtained from the Company.

Any opinions or estimates given may change. GreenWave Advisors, LLC undertakes no obligation to provide recipients with any additional information or any update to or any corrections of the information contained

herein. GreenWave Advisors, LLC, its owners, officers, employees, affiliates and partners shall not be liable to any person in any way whatsoever for any losses, costs or claims howsoever arising from any information contained herein or any inaccuracies or omissions in the information contained herein or any reliance on that information.

Reproduction and Distribution Strictly Prohibited. The research reports are produced for the exclusive use clients of GreenWave Advisors LLC. No user of the research reports may reproduce, modify, copy, distribute, sell, resell, transmit, transfer, license, assign or publish the research report itself or any information contained therein.