KEY POINTS

- Now on the cusp of federal reform (timing of which is unknown), the cannabis industry appears at an inflection point with the growth prospects and legitimacy we outlined in 2014 beginning to materialize.

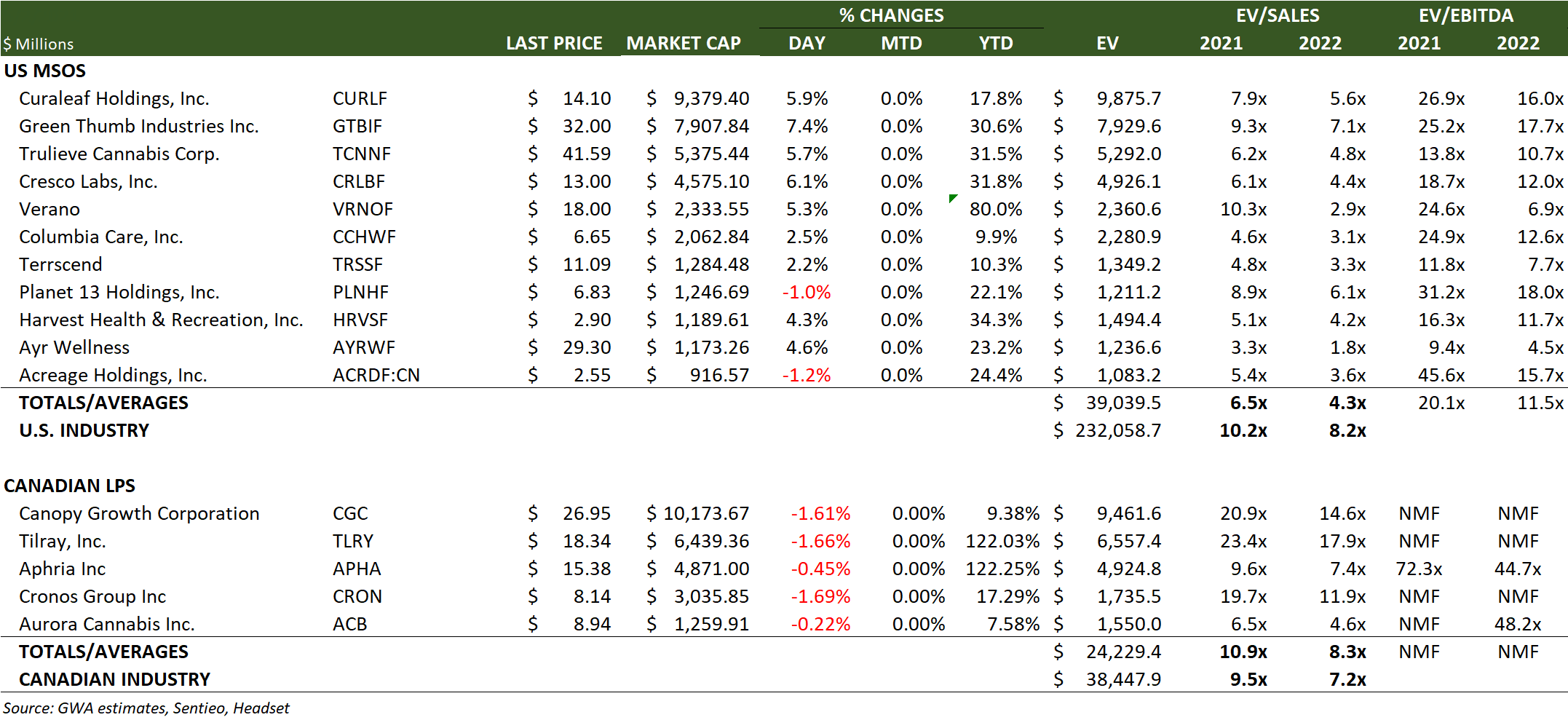

- Our review of a grouping of publicly traded MSOs for CY ’19 and ’20 with a market cap >$1B, determined revenue growth of these ‘majors’ outpaced the broader cannabis industry by a wide margin YoY (170% vs 43%) yet this group trades at a discount (4.0x ’22 EV/Sales) relative to the industry as a whole (7.6X extrapolated from this grouping which accounts for ~18% of total retail sales of ~$19B in 2020). The reverse holds for the Canadian LPs; top tier is at 8.1x vs the sector at 7.0x (and accounts for ~ 54% of ’20 sales in Canada).

- Cannabis companies bear added costs of prohibition (280E tax in particular) which limits the ability for many of these concerns to fund operations internally. Cash flow, particularly as sources of capital remain somewhat limited, is an important metric for investors to consider in the comparative analysis of U.S. MSOs. A focus on cash also normalizes the “accounting noise” associated with reporting under IFRS vs GAAP.

- We analyzed cash flows from operations (CFO), adjusted for taxes paid in the prior year, to ascertain if the business generates enough cash to pay the year’s current tax provision (companies with CFO payout ~ 50-80% in taxes).

- With 2 years of audited financial statements under review, we note steady cash flow generation improvements across the board. However, US MSOs continue to trade at a discount to their Canadian LP counterparts (4.0x vs 8.2x ’22 EV/Sales). While the fundamentals of the former remain stronger, perhaps the disconnect can partly be attributed to the LPs ability to attract institutional investors (federally legal in Canada).

- The industry continues to evolve with ongoing M&A activity as new and existing participants jockey for leadership positions. To this end, we would not be surprised (nor should investors) for ongoing volatility in the quarterly reporting of gross and EBITDA margins due to variations in the timing of deal closings and integration costs (we believe for these reasons, some of the MSOs have not provided guidance for 2021).

- The added costs of prohibition could become increasingly problematic for many of the smaller operators which could provide an opportunity for the better capitalized concerns to make accretive acquisitions at distressed levels.

SOME BACKGROUND

As many are well aware, in 2014 the nation’s first recreational use market was implemented in Colorado. Investor focus was drawn to the economic and social consequences of this “experiment” and whether this model would not only prove to be a workable and desirable response to the voters expressed intentions for the legalization of marijuana use, but in what ways its real and perceived results would also influence the development of regulations in other states and perhaps eventual national oversight.

The progression towards federal reform is easily measured. More states have legalized cannabis since the beginning of 2014 (20 medical and 2 recreational use which now stands at 36 and 15 respectively) and the results of last years’ election (and Georgia runoff) has served as a catalyst for other state legislative measures in 2021, most notably recreational use in New York State. Impressively, revenues reached ~$19 B in 2020 up from ~ $3B in 2014.

Despite the cultural, economic, and political advances in Cannabis acceptance and appeal by a majority of Americans, the Federal Government continues to maintain its prohibitive legal status. Nonetheless, the pressures brought to bear by the multitude of state statutes that have locally decriminalized and regulated marijuana have continued to gradually stimulate business development within the industry.

As we approach the end of prohibition, the picture for investment is obviously much clearer than it was in 2014 because there is a greater level of transparency. Many Multi-State Operators (MSOs) are listed companies that require public filings from which we can now draw conclusions based upon a full 2 year history. Furthermore, each state reports varying levels of detail regarding its cannabis commerce also with increasingly greater transparency.

CASH FLOWS AND TAX ANALYSIS

In this analysis, we looked at all MSO’s with a market cap >$ 1B. We analyzed cash flows from operations (CFO), adjusted for taxes paid in the prior year, to ascertain if the business generates enough cash to pay the year’s current tax provision (companies with CFO payout ~ 50-80% in taxes).

With 2 years of audited financial statements under review, we note steady improvements across the board in terms of cash flow generation as illustrated below.

TABLE 1; MSO COMPARISON – TAX BURDEN AND CASH FLOW

VALUATION GAP

US MSOs continue to trade at a discount to its Canadian LP counterparts (4.0x vs 8.2x ’22 EV/Sales) though fundamentals of the former remain stronger. Perhaps the disconnect can partly be attributed to the LPs ability to attract institutional investors (federally legal in Canada).

We also note this grouping of MSOs trades at a discount to what the theoretical multiple is for the U.S. industry taken as a whole; the reverse holds true for the Canadian LPs. (EV/Sales ‘22 for the MSO group is 4.0x and the industry (extrapolated) currently at 7.6x; Canadian LPS at 8.1x vs Industry at 7.0x).

In this exercise, we extrapolated from the MSO group’s percentage of retail sales in 2020 (18%) to determine a theoretical Industry Enterprise Value and divided by industry estimates for 2021 and 2022 (per Headset). We used the same methodology for Canada.

TABLE 2: RELATIVE VALUATIONS