REGULATORY

REGULATORY

A Federal de-criminalization bill introduced in the Senate; not likely to pass but sets in motion further discussions.

The Cannabis Administration and Opportunity Act (CAOA), was introduced into the Senate last month ( drafted March 2021). We share the consensus view that this bill is not likely to pass in the Senate because it is too broad and won’t get the 10 Republican votes needed. The bill proposes a federal excise tax of up to 25% which in our view is excessive and would only incentivize consumers to effect purchases via the illicit market. Also, we estimate a tax of ~10%-15% would suffice to replace lost 280E revenues (see our post, Will a Federal Excise Tax Replace Lost 280E Revenues ).

Schumer Marijuana Legalization Bill Finally Introduced in Senate

Perhaps Marijuana research is needed before Senate Republicans are willing to support full legalization?

US House Passes Marijuana Research Bill; Senate Expected to Follow Suit

Importantly, the conclusions drawn from comprehensive research studies should provide lawmakers with a better (and necessary) understanding of the benefits and risks associated with cannabis. Perhaps some Republicans have pushed back in support of legalization for fear of the unknown. Also, this bill is significant because it is the first piece of stand alone cannabis legislation presented to a President for signature.

In the meantime, Senator Corey Booker (D-NJ) is leaning towards supporting SAFE banking.

Booker Says He’s ‘Open To Compromises’ Such As Passing Marijuana Banking With Equity Provisions

Q2 EARNINGS EXPECTAIONS AND CALENDAR (next 2 weeks)

The U.S. MSO Q2 earnings season kicks off tomorrow with Green Thumb Industries.

All eyes will be on the results of New Jersey’s recently implemented recreational use market (commenced 4/21) and perhaps commentary on recent media reports that suggest supply shortages in the state. MSOs in NJ include Terrascend (CSE: TRSSF) , Ascend Wellness (CSE: AAWH) , AYY Wellness (CSE: AYRWF) Curaleaf (CSE: CURLF), Green Thumb Industries (CSE:GTBIF) Acreage Holdings (ACRHF) Verano (VRNOF) Columbia Care (CCHWF).

In general, based upon our analysis of data reported by various state markets in Q2 we expect a modest improvement in QoQ revenues (flat to slightly up).

We expect continued variability in reported gross and EBITDA margins as previously announced acquisitions are integrated, new state markets are implemented, and ongoing price compression. In our view, these are all temporary issues that should come as no surprise as the industry continues to evolve and consolidate. It is possible that some firms will report write downs on prior acquisitions as market conditions have worsened. In our view, the most relevant metric for investors to focus on, is cash flow from operations. Those MSOs that are or near able to fund its cash requirements are the ones to watch, particularly as the cost of capital remains high for cannabis companies (see our post– “Cash is King, Which MSOs are most efficient” ).

ACCOUNTING and TAX

Verano Holdings Restates Financials

A restatement can displace investor confidence. With Verano, it raises added concern because this is the second time that the financials were restated. Also, it brings home the point that cash flow is a more meaningful metric to assess operational performance than earnings.

But, bigger picture, this underscores some of the growing pains that the Cannabis industry is faced with. Early on, there were very few accounting firms that would take on an audit engagement of a cannabis company because of federal illegality. Accordingly, there was no “authoritative guidance” on how to account for pot, notwithstanding the fact that many cannabis companies lacked and were unable to attract the in-house accounting and finance expertise that other industries were able to employ (i.e. nobody would quit a job with a fortune 500 to go work for a company that is federally illegal).

A restatement certainly doesn’t help investor confidence in an industry already plagued with an abundance of issues, but it isn’t surprising that these issues would come up given that we are still in the early innings.

IRS Settles with Statehouse (formerly Harborside)

CANNABIS SPACs

Choice Consolidation Winds Down

Choice states, “shifting market conditions and political gridlock delay ability to identify and complete qualifying transaction with permitted timeline.” This decision underscores the inherent challenges of getting a deal done. There remains ~$1B in the pipeline (7 SPACs). Most targets are in the range of 2-3x the amount in trust (basically the IPO proceeds) which would imply ~$2B – $3B in transaction value. It remains to be seen if any of these SPACs will follow suit.

With respect to Northern Lights (NASDQ: NLIT), its still awaiting the regulatory green light to combine with Safe Harbor Financial.

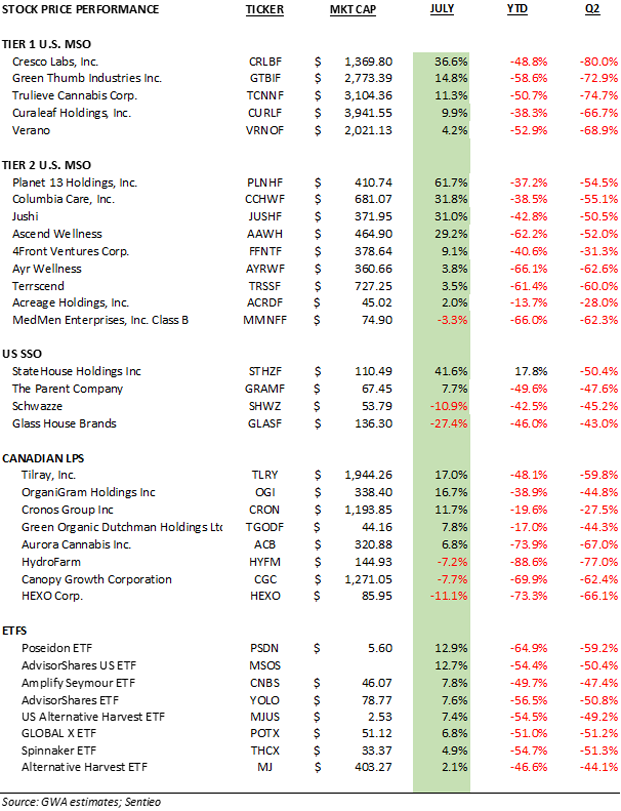

STOCK PRICE PERFORMANCE