TERRASCEND SETS IN MOTION UP-LISTING TO THE TORONTO STOCK EXCHANGE

Last week, Terrascend announced that it filed an application to list its shares on the Toronto Stock Exchange (TSX). The company indicates that in order to qualify for listing, it will need to complete a reorganization. The specifics have not yet been disclosed, but this announcement follows Canopy Growth Corporation’s plans (October ‘22) to consolidate its U.S. THC assets into a new holding company (Canopy USA). Terrascend could propose a similar structure because it was originally formed as a Canadian-domiciled company.

While an up-listing from The Canadian Stock Exchange (CSE) will certainly provide added liquidity (average daily trading volume of the TSX is ~8x that of the CSE) and thus currency for future M&A activity, it is not necessarily a green light for institutional entry – that will primarily come from a rescheduling or delisting off of the Controlled Substances Schedule. The following provides some perspective on current institutional ownership of the Tier 1 US MSOs.

Full Article

NEW YORK’S FMEDICAL MARIJUANA MARKET FAILURE– A PRECURSOR TO RECREATIONAL USE ROLLOUT?

Back in the early days of New York Cannabis, it seemed a forgone conclusion that a regulated medical cannabis market would have little chance of success given former Governor Cuomo’s initial opposition to legalization . After contentious deliberation, an overly restrictive market was implemented (few qualifying conditions, burdensome requirements for physician participation etc).

Accordingly, the investment thesis centered around a likely “call option” for those license recipients to serve a much broader consumer base upon the inevitable legalization of recreational use. As most know by now, the hope for a seamless transition from medical to recreational sales has not materialized. Moreover, New York remains challenged by a robust and sophisticated illicit market that continues to operate under the shadow of state and federal laws.

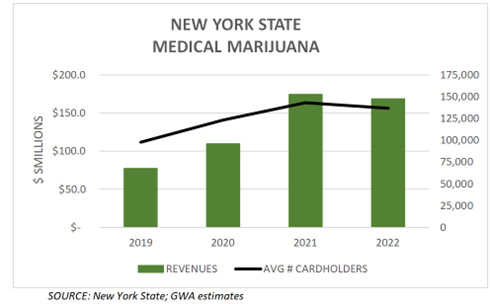

The chart illustrates the program’s lackluster revenue growth over the past four years which may call to question its sustainability, particular as a new recreational market rolls out. In total there are 40 dispensaries (each of the 10 license holders operates 4 stores) to serve ~ 122K cardholders (as of 1/31/23) out of an addressable market of ~1.8M (penetration of ~7% in comparison to Colorado (as one example) which peaked at about 33%; in 2014; we defined the addressable market by the number reported cases of each qualifying condition by state).

Former NJ Gov Christie shared Cuomo’s anti-cannabis sentiment, but a newly elected Gov Murphy quickly took action to ease restrictions and expand its existing medical program for an easier transition to recreational use. Today, some of the major MSO’s are thriving in the Garden State perhaps due to Murphy’s preemptive measures.

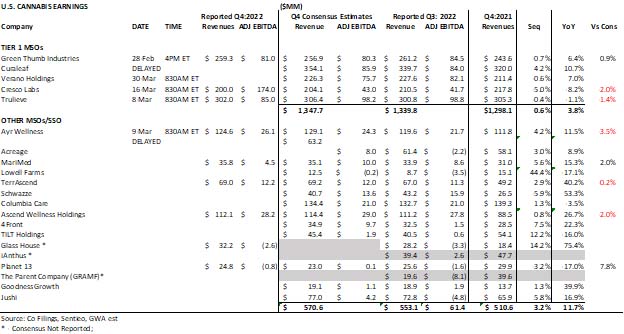

EARNINGS CALANDAR

So far, Q4 earnings have been a mixed bag with tempered expectations going into the print (generally flat sequential top line growth). Several have not yet reported. For the remainder, we don’t expect any surprises to the upside – with flat revenue growth and variability in gross and EBITDA margins over Q3 for a whole host of reasons (acquisition integrations, price compression, closures/sales etc ). Curaleaf and Acreage have both put Q4 earnings on hold “until further notice” to resolve accounting issues.