When investors contemplate capital shifts into the cannabis sector there remains the risk obstacle of the federal government’s intransigent position of classifying marijuana as a schedule I drug, having no medical value and having high potential for abuse. By lumping marijuana, both in its non-psychoactive CBD and THC forms, with heroin, LSD, and other hallucinogens, the DEA maintains the constant threat of confiscation and prosecution over the head of marijuana enterprises that “touch” the flower. This risk cannot be ignored but the increasing public acceptance and expansion of state sponsored cannabis laws leads us to believe that the traditional role of the DEA in the monitoring and control of marijuana may become demonisms and perhaps gravitate on the verge of eventual irrelevancy.

Presently Marijuana businesses are confronted with the twin burdens of taxation and banking practices. As long as the DEA effectively defines the federal legality of marijuana and its various businesses, regardless of state permissions, these businesses are forced to operate under adverse taxing regulations (most notably the inability to deduct most business expenses from gross revenues) and find it difficult if not impossible to bank or traditionally finance their business. Federally chartered and insured financial institutions remain shy of running afoul of regulations.

Therefore, it has been understandable that investors have worried that although they believe in the long term viability of marijuana related investments, that their interests could suddenly vanish if the federal government were to not only continue to maintain the legal impediments to normal business activity but perhaps even claim law enforcement jurisdiction over state mandates.

To these concerns, much hope and anticipation was vested in the outcome of the past election. General consensus was that a Clinton Presidency would foster an easier road to re-classification or perhaps even delisting of marijuana. Candidate Trump’s meager remarks on the subject appeared to tolerate medical uses of marijuana as well as the rights of states, in general, to determine for themselves. This was at best an undeveloped plank in any forward policy as the realities of states’ rights has always been tempered by federally mandated moral standards such as abortion, labor, and environmental rights. Events subsequent to the election have shown no clearer light on the subject of marijuana rights.

The march towards majority acceptance as state after state approve marijuana for medical and recreational use has created a multi headed economic juggernaut that may prove out to be more influential in future federal policy than the DEA and it’s antiquated hold on marijuana. Firstly, state tax and fee revenues have proven substantial and politicians have taken notice. Secondly, private enterprise has recognized the great potential of the cannabis market and all of its related sectors, thus creating new sources of private revenues as well as jobs and overall economic stimulation. Additionally, the widespread interest in cannabis and its derivatives as a substitute for conventional medical applications is causing a stir that Big Pharma will find increasingly more difficult to ignore or prevent. It is perhaps the influence of Big Pharma that has been most resistant to DEA flexibility along with the DEA’s inherent budgetary advantages in keeping marijuana illegal. But with the onset of “marijuana pharma” companies, many doing research and development abroad, the inevitable handwriting may already be on the wall. The acquiescence on the part of the FDA to grant orphan and trial status to developing applications is a strong signal that the days of DEA’s sole jurisdictional influence over marijuana are numbered.

As more and more states join the legalization movement for medical and recreational use marijuana these economic and political realities are steadily becoming an overwhelming force that will rival, if not dominate, the posture and actions of the DEA and Justice Department. State tax revenues and public support for decriminalization are driving politicians towards acceptance and advocacy.

As a result of the growing economic opportunities created by the marijuana explosion, politicians from both parties are falling own the side of legalization. New Bills have been offered in Congress that would, if enacted, change the status of scheduling, national legalization, and protections of seizure. H.R. 714, or “LUMMA,” would “provide for the legitimate use of medicinal marihuana in accordance with the laws of the various States.” Another bill, H.R. 715, or the “Compassionate Access Act,” would amend the Controlled Substances Act (CSA) and formally recommend to the DEA a rescheduling of marijuana. Though we do not presently hold strong opinions on the passage of any one or more specific piece of legislation, we do note and place critical importance on the mere level and scope of the legislative activity. Simply put, if Congress passes laws that in effect legitimize the use of cannabis, even if done incrementally, the erosive effect on DEA influence will be inevitable. We therefore suggest that investor attention be focused on the legislative trends and processes with a dwindling obsession for the acts and motives of the DEA.

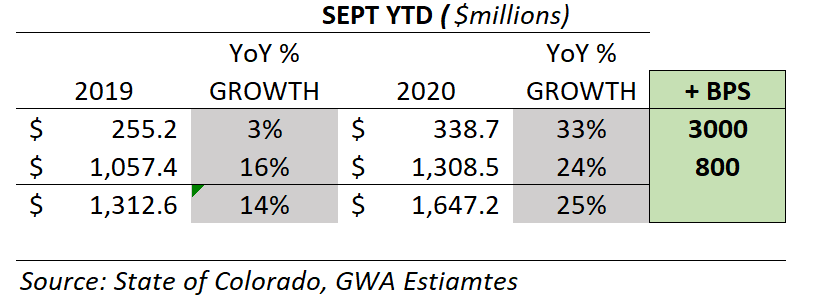

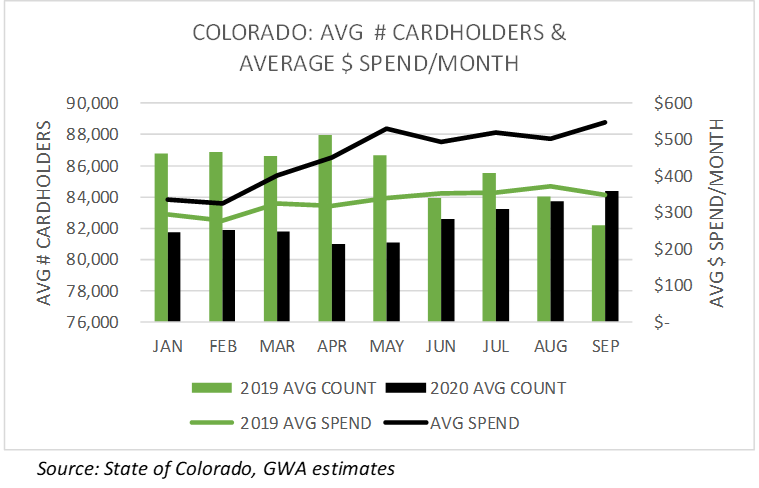

- Since the pandemic, we note an uptick in cardholder counts (+3K) coupled with a sharp increase in monthly spending. This trend could also suggest that existing cardholders are “buying low and selling high “spending more for resale into the “gray market” (purchased in the legal market, sold in the illicit market). Because cannabis is deemed an “essential business”, we don’t think that the increased level in spending is attributed to “hoarding” (though entirely possible in some markets for both recreational and medical use).

- As the bellwether for the U.S. Cannabis industry, Colorado could be an indicator of similar trends experienced in other recreational use markets. Our analysis is based upon information provided by the state of Colorado and is not derived from point of sale data. Cannabis regulations and disclosures vary by state and with a 6+ year track of regulating a dual market, we think Colorado could serve as an indicator of similar trends experienced in other U.S. bifurcated markets.

Eventually we think these trends will return to the norm with more growth to come from the recreational market. With the imminent end of federal prohibition, we recognize that this shift could prove inconsequential as the medicinal (as defined today) and recreational use markets combine into one substantially larger market (medical use will be redefined and re-calibrated with precise dosage, efficacy etc. similar to other health/wellness products).