- The long-term prospects for industry growth remain compelling as more states legalize cannabis.

- Near-term fundamentals are hampered by a thriving illicit market, lack of law enforcement, price compression and added costs associated with prohibition most notably, the punitive 280E tax.

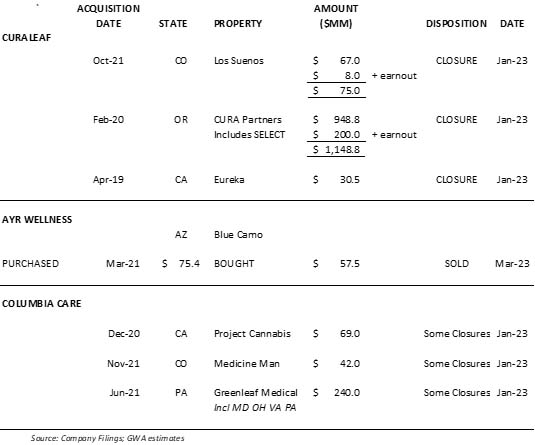

- In 2022 impairment charges totaled over $1.9B; In short order some firms have either abandoned or sold non-performing assets.

- Prolonged federal illegality will make it increasingly more difficult for many firms to continue as a going concern while others will benefit from accretive acquisitions at distressed valuations.

- The timeline for federal legalization, seems to remain hostage to a politically driven timetable. and changes to legislation may fall into play as the 2024 election cycle draws closer.

Full Article

In January 2014, nearly a decade ago, Colorado implemented the nation’s first recreational use cannabis market . Of great interesst was what influence would the real and perceived results of the “Colorado experiment“ have on the development of regulations in other states and perhaps eventual national oversight. The capital invested into the sector over the years has been substantial and investors remain interested in the economic and social consequences of federal legalization.

Today, medical marijuana is legal in 38 states plus DC and fully legal in 23 states plus DC. State and local regulators have been inconsistent in the approach and timing for the rollout of these new markets adding another level of complexity for companies operating in multiple jurisdictions.

In 2022, legal sales totaled ~$25M in the U.S. which could reach `~$100M upon maturity with a federally legal national footprint. While timing is uncertain, the industry potential is undeniably staggering. The growth prospects has sparked the interest of institutional investors, big pharma, tobacco and alcohol all of which are all on the sidelines waiting to step up in a meaningful way.

Last year before the mid-term election, President Biden directed the Secretary of Health and Human Services and the Attorney General to “initiate the administrative process to review expeditiously how marijuana is scheduled under federal law”. This directive comes on the heals of the Drug Enforcement Agency ‘s authorization for expanded cannabis research beyond the University of Mississippi. The timeline for actual federal legalization, however, seems to remain hostage to a politically driven timetable. We anticipate that changes to legislation may fall into play as the 2024 election cycle draws closer.

It stands to reason that before federal legalization occurs, lawmakers need to better understand more specifically how the industry will be systematically regulated. A recently proposed bipartisan bill, The Post-Prohibition Adult Use Regulated Environment (PREPARE) Act, would establish a framework for a comprehensive federal regulatory system. It would likely include, among other provisions, a national protocol on lab testing and packaging/labeling.

The Industry Remains Under Pressure

U.S. Cannabis share prices fell rapidly in Q4 following 1) Congress’s failure to pass The SAFE Banking Act and 2) weaker fundamentals due to a robust illicit market, ongoing price compression and overall economic uncertainty. On average the sector is down nearly two fold off its 52 week high.

The dire state of the industry in considerable part can be attributed to the lack of clearly defined and enforceable regulatory reforms as well as the added costs of prohibition, most notably the punitive tax burden associated with section 280E of the IRS code. Prolonged federal illegality will make it increasingly more difficlut for many firms to continue as a going concern. Conversely, the opportuntiy for accretive acqusitions from distressed asset sales is in play.

Furthermore, the complexity of the U.S. cannabis industry has been exacerbated by the consequences of states operating within the confines of closed economies that strive for their own interpretations of legitimacy under the shadow of existing federal laws. This variation of standards from one state to another carries an inherent uncertainty for businesses and investors with respect to how the industry will operate subsequent to the delisting or reclassification of cannabis as legal standards evolve. Many state and local regulators, have brought on insurmountable challenges for public and privately held companies in executing their business plans and meeting expectations. This has limited the ability for most cannabis concerns to generate sustainable levels of cash at a time when capital is scarce.

Unsurprisingly, these inefficiencies, along with the inherent challenge of recruiting and maintaining top talent has negatively impacted operating performance. Some of the repercussion include:

- Impairment charges related to goodwill and other intangible assets totaled over $1.9B in 2022 with more likely to come in 2023. The top 13 MSOs reported a total of ~ $10.3B in goodwill and intangible assets at the end of Q3:22. In Q4 these balances were reduced by ~$1.5B (~15%) and reported as impairment charges (excludes Curaleaf which has delayed filing form 10k).

- Entry into new state markets that, in short order, have been left idle or sold. In some cases, asset sales were necessary to provide liquidity while in other instances, revenue expectations and profitability were curtailed by ongoing pressures from the illicit market. Recent announcements include:

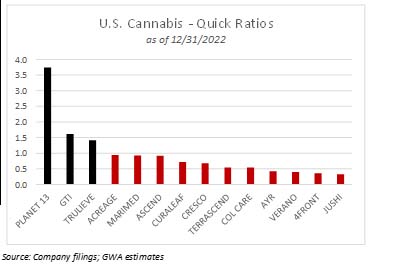

- Limited access to banking and lack of SBA funding during the pandemic has contributed to a short runway over the next 12 months. A snapshot of the quick ratio among the major MSOs reveals that as of the end of 2022, a small number (Planet 13, Green Thumb and Trulieve) are readily able to satisfy obligations coming due within the next twelve months (note that subsequent liquidity events in Q1 has improved some of these profiles). Perhaps this picture would look a little better if during the COVID pandemic, SBA funding was made available to cannabis businesses (net of the temporary uptick in revenues from consumer stimulus payments). Additionally, as the smaller entities find it increasingly more difficult to pay vendors, credit risk could become more problematic for the larger operators that sell product wholesale to these businesses. Although The SAFE Act was re-introduced last month with bi-partisan support, the likelihood of passing this year remains uncertain. Nonetheless, the eventual passage would mitigate operational risk (no longer dealing in all cash) and could provide liquidity to many struggling enterprises with the availability of working capital financing.

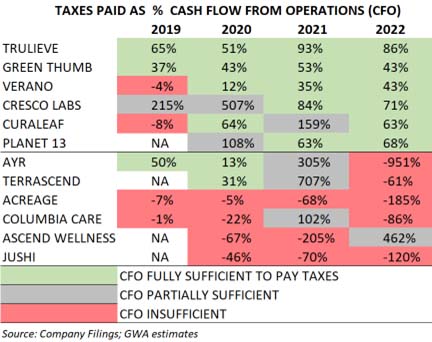

- Only a few operators are able to generate enough cash flow from operations to pay taxes. With 4 years of public disclosures, we are better able to analyze and assess the financial and operational performance of the U.S. Multi-state Operators (MSOs). The added costs of prohibition, most notably 280E tax requirements, are significant and when federal legalization occurs and these extra costs are no longer required, cash flow profiles should accelerate significantly. As the chart indicates, the larger MSOs have been able to achieve scale and consistently generate enough cash to actually pay the large tax burden.

- Ongoing delays in financial reporting/ restatements/ auditor turnover. Before most institutional investors are able to deploy capital in a meaningful way, improvement is needed within corporate governance and in some cases executive leadership. There have been numerous delays in earnings releases, restatements of previously issued financial statements (quarterly and full year audited) and changes in auditors over the years. The deficiencies to some extent are correlated to a challenging internal control environment exasperated in some cases as the result of operating in an all cash environment compounded by inexperience both within many of the companies as well the accounting/finance/audit professionals that serve the industry. This makes the due diligence process even more challenging when evaluating a potential acquisition as the likelihood of financial reporting errors is more likely.