IRS reiterates its position on 280E. The IRS recently issued a press release reminding taxpayers that until a final federal rule is published on the reclassification of cannabis to Schedule 3, 280E remains in effect. In the meantime, a few of the Multi-State Operators (MSOs) have filed amended returns seeking refunds for 280E tax previously paid. Per the IRS, “the grounds for filing such claims vary, but these claims are not valid. The IRS is taking steps to address these claims.”

Earlier this year, we hosted a webinar with Michael Harlow, CPA – CohnReznik, and Nate Pollock, Esq. – SouthBank Legal. Replay

Full Article

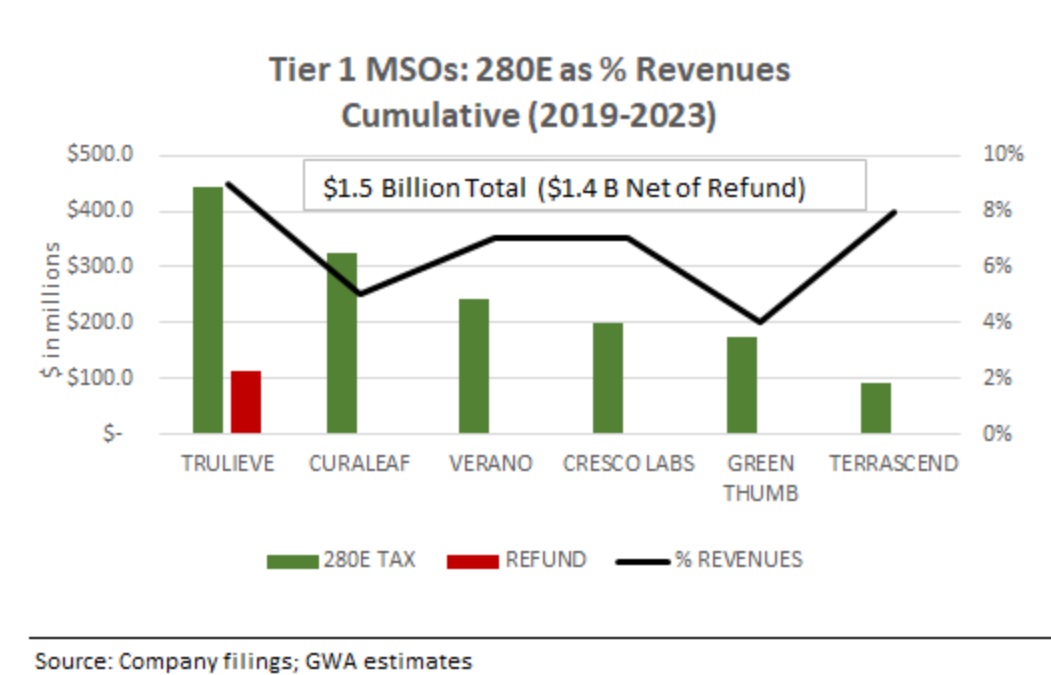

Will Trulieve have to pay back its $100M+ Refund? Trulieve announced on its Q3:23 earnings call that it filed amended federal tax returns for 2019, 2020, and 2021, claiming a total refund of $143 million, challenging the applicability of 280E. To date, $113M has been received. Additionally, for 2022, it is seeking $148M, and for 2023, it filed as a regular taxpayer but accrued the 280E expense as an “uncertain tax position” (long-term liability). As of 3/31/24, Trulieve has a tax liability of about ~$250M and has ~$320M on hand.

Terrascend and Ascend Wellness have filed amended returns using the same accounting treatment as Trulieve.

Recovery of Past 280E still on the table?. Regardless of the IRS position, past 280E tax payments could be recovered pending a successful outcome of the Boies Schiller Litigation . While the U.S. District Court for the District of Massachusetts’s Western Division recently dismissed the case, it could head to the Supreme Court. If the SCOUS does rule in favor of the plaintiffs it is unclear as to when the 280E clock would stop, how much would be refunded as well as timing (could take several years).

280E is not sustainable. A final rule on the reclassification of Cannabis to Schedule 3 could come before the election, but, in the worst-case scenario, by year-end, in our view. Some suggest that a new Attorney General under the Trump administration could disrupt the approval process. However, we view that scenario as highly unlikely. The train has been moving for the past ten-plus years (since Colorado implemented the first recreational use market), and it’s not turning back. Too much capital has been deployed, and significant economic benefits have materialized, among other reasons.

To put in perspective just how onerous 280E has been over the past five years (2019-2023), the Tier 1 MSOs collectively incurred $1.5B in 280E tax, yet over the same period, pre-tax losses totaled $890M. A back-of-the-envelope calculation suggests $187M ($896M x 21%) in lost federal tax credits because cannabis companies cannot carry losses forward to offset future income while cannabis remains in Schedule 1.

As the chart illustrates, for the Tier 1 MSOs, Green Thumb Industres , Trulieive and Cresco Labs have sufficient levels of cash on hand to pay taxes owed-the remaining fall short.