-

With the progression of individual state regulated markets, entrepreneurs, investors and other industry participants have remained intoxicated by the prospects for federal cannabis reform. These interests have been further inspired by the U.S. Federal Government’s heretofore reluctance to interfere with legal cannabis businesses.

-

Nearly 10 years since Colorado implemented the nation’s first recreational use market, the U.S. Cannabis sector is potentially on the cusp of regulatory change. The Drug Enforcement Agency (DEA) could opine on the Department of Health and Human Services (HHS) recommendation to reclassify Cannabis from Schedule I to Schedule III by year end. If re-scheduled to III, 280E taxes (the most significant cash drain) no longer applies which will likely trigger an industry “reset” with new sources of capital, improved cash flow profiles and ultimately higher valuations.

-

Third quarter results marked improvement over Q2 for the Tier 1 MSOs, underscoring the notion that “the strong get stronger,” while Tier 2 performance brings into question their ability to remain independently viable going forward. Revenue growth was driven by new store openings and the implementation of Maryland’s recreational use market on July 1. Pricing pressure however, remains a concern. Effective cost controls resulted in better margins and operating cash flows. Also, several companies have better managed street expectations as actual results fared better or were in line with analyst estimates.

-

Volatility in quarterly operating metrics, including Gross and EBITDA margins, is still to be expected for all MSOs as the industry continues to evolve. Legalization may have been somewhat predictable in some of the liberal-minded western states, however, the growth expectations we previously assumed would catapult the industry nationwide have failed to discount the nuances of regional politics and the ability of opposition forces to bog down the clarity of regulatory reforms. The notion that a few states would lead with “best practices” for others to follow simply did not materialize.

-

The ability to scale and generate sufficient levels of operating cash flow to satisfy current tax obligations as a result of the 280E burden is arguably a differentiating factor among operators. The current darlings include: Tier 1: Green Thumb Industries, Trulieve and Verano; Tier 2 is represented solely by Marimed.

Full Article

The following provides a score card for many of the U.S. operators:

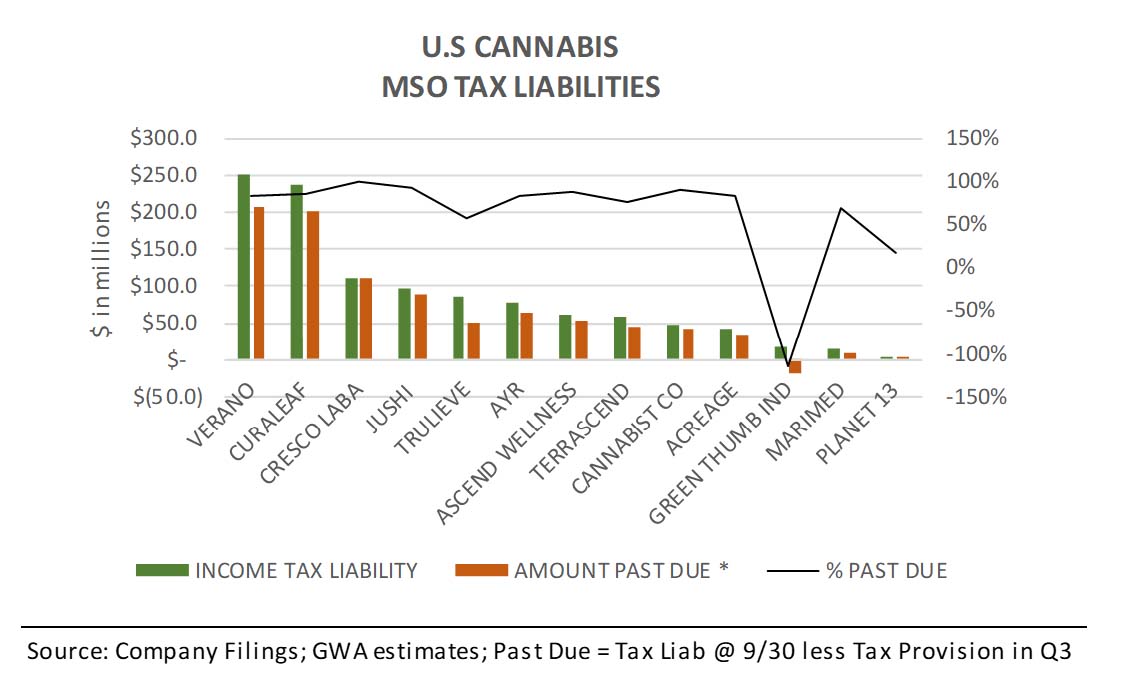

As liquidity concerns continued into 2023, several operators have deferred tax payments. We believe this strategy is somewhat a “roll of the dice” because the IRS assesses a penalty of 6% on the outstandings and 8% interest compounded daily. In some cases, penalties are negotiable but, “all in” ~14% may exceed the current cost of debt financing for some. Additionally, last month, a coalition of U.S. operators and investors sued the U.S. DOJ for back taxes, and a win would stop the “280E clock” effective on the date the lawsuit was filed. Perhaps some are holding off payment by taking a “wait and see” approach.

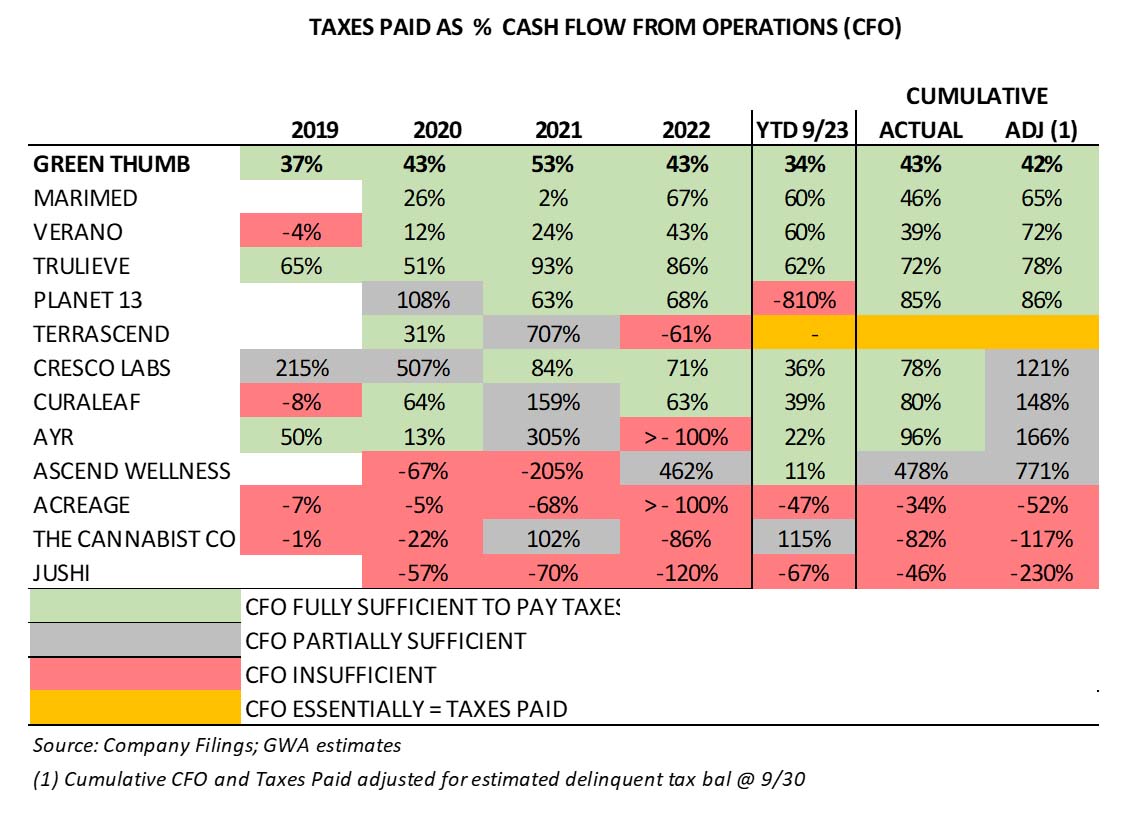

The table below illustrates cash taxes paid as a percentage of Cash Flow from Operations (CFO) among several MSOs over the course of ~5 years (2019 – 2023 YTD). Cannabis companies are taxed on Gross Profit vs Net Income because of the Section 280E of the tax code. This analysis provides some color (no pun) on which firms have generated sufficient levels of cash from operations to pay taxes either in full, in part, or not at all (effectively having to raise capital to fund tax liabilities).

Accordingly, to provide a more meaningful comparison, this metric was also calculated on a cumulative basis (2019 – 2023 YTD) with and without adjusting for past due tax balances. In other words, this shows what the cash flow would look like if each operator made tax payments on a timely basis. This provides a more meaningful, apples to apples comparison.

This illustrates, for example, that Green Thumb Industries has consistently generated sufficient levels of cash from operations to pay its tax liabilities on a timely basis. Since 2019, 43% of its operating cash flow was used to pay taxes leaving ~57% for growth. On the other hand, Jushi has, in effect had to raise capital to fund its tax liability over the same period.

In summary, we see the following as near-to- medium term catalysts:

- Re-scheduling to III (and elimination of 280E)

- SAFER Banking

- Garland Memo

- Implementation of Ohio’s recreational use market

- Legislative or ballot measure wins – PA, FL, VA

- A win by the coalition of U.S. cannabis operators and investors against DOJ.

Risks to Consider:

The Potential for Dilution as Each State Looks to Expand the Number of Licenses Issued. In some limited license states, we have seen a steady increase in the number of license awards, i.e. New York State and Florida. These regulatory moves result in dilution to existing business owners which could continue as each state continues to evaluate the profitability and effectiveness of its legal cannabis market.

How the Industry will be Regulated Once Prohibition Ends. Even if Prohibition were to end tomorrow, uncertainly remains as to how the industry will be regulated and under what timeframe. A business that may appear as a sound investment today, may not be permitted to operate in the same capacity tomorrow, if at all. Also, the loophole associated with the Hemp Farm Bill may prove a cautionary tale as many companies remain in limbo awaiting rulings from various regulatory agencies.

Disclaimers

The Controlled Substances Act regulates, among other things, the cultivation, possession and distribution of certain controlled substances, including Cannabis and Marijuana which are illegal under federal law and in many states. This is true whether or not it is possessed for qualifying medical conditions, as provided for in certain state medical marijuana laws or if it is possessed within the few states that permit non-medicinal Adult (Recreational) Use.

There is nothing in this briefing written to offer any legal advice or to suggest any actions or choices the reader may make regarding participation in this industry or in any of the businesses discussed.

Nothing contained in this report or any distribution by GreenWave Advisors LLC should be construed as any offer to sell, or any solicitation of an offer to buy, any security or investment. Any research or other material received should not be construed as individualized investment advice. Investment decisions should be made as part of an overall portfolio strategy and you should consult with a professional financial advisor, legal and tax advisor prior to making any investment decision. GreenWave Advisors LLC shall not be liable for any direct or indirect, incidental or consequential loss or damage (including loss of profits, revenue or goodwill) arising from any investment decisions based on information or research obtained from the Company.

Any opinions or estimates given may change. GreenWave Advisors, LLC undertakes no obligation to provide recipients with any additional information or any update to or any corrections of the information contained herein. GreenWave Advisors, LLC, its owners, officers, employees, affiliates and partners shall not be liable to any person in any way whatsoever for any losses, costs or claims howsoever arising from any information contained herein or any inaccuracies or omissions in the information contained herein or any reliance on that information.

Reproduction and Distribution Strictly Prohibited. The research reports are produced for the exclusive use clients of GreenWave Advisors LLC. No user of the research reports may reproduce, modify, copy, distribute, sell, resell, transmit, transfer, license, assign or publish the research report itself or any information contained therein.