The GreenWave Buzz

our proprietary analysis and commentary on what’s relevant in the cannabis space

Sign-Up for The GreenWave Buzz

Get our latest news direct to your inbox

RE-SCHEDULING MARKS A NEW DAY FOR NET OPERATING LOSS (NOL) CARRYFORWARDS

Section 280E of the Internal Revenue Code disallows businesses from deducting otherwise ordinary business expenses from gross income associated with the “trafficking” of Schedule I or II substances, as defined by the Controlled Substances Act. Once moved to Schedule...

Distribution Mayhem In California: Who’s Left Holding the “Bag”?

Herbl, one of California’s largest licensed cannabis distributors is in receivership. Last year it served ~1K retailers and accounted for ~18% (~$700M) of the state’s $3.8B retail sales amount. Other licensees could be at or near a similar breaking point. California...

ONE STEP FORWARD ON THE ROAD TO FEDERAL REFORM

The announcement last week by the department of Health and Human Services (HHS) that it is now recommending the rescheduling of cannabis from schedule I to III, marks a significant inflection point for federal cannabis reform. The timing of the Drug Enforcement Agency...

STIRRING THE POT IN CALIFORNIA: CANNABIS SALES OVERSTATED BY $6 BILLION (2018-2022)

Beginning in Q1:23, California cannabis excise tax reporting shifted from distributor to retailer. With this change, the state provides an added layer of transparency in reporting cannabis sales. Our analysis reveals that prior period revenues (2018-2022) are...

The GreenWave Buzz – May 3, 2023

The long-term prospects for industry growth remain compelling as more states legalize cannabis. Near-term fundamentals are hampered by a thriving illicit market, lack of law enforcement, price compression and added costs associated with prohibition most notably, the...

Terrascend Sets In Motion Up-listing to the Toronto Stock Exchange

TERRASCEND SETS IN MOTION UP-LISTING TO THE TORONTO STOCK EXCHANGE Last week, Terrascend announced that it filed an application to list its shares on the Toronto Stock Exchange (TSX). The company indicates that in order to qualify for listing, it will need to...

Recent Headlines, Commentary and Upcoming Catalysts – 9/9/2022

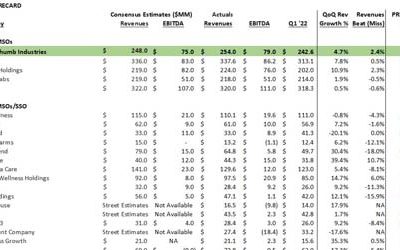

Q2 Earnings Season Recap Generally speaking, the larger MSOs continue to execute, while it’s becoming increasingly more challenging for the smaller players to scale and generate cash flows needed to support current operations. Q2 revenues were in line with our...

Q2 Earnings Season Commentary – 9/1/2022

Summary Generally speaking, the larger MSOs continue to execute, while its becoming more of a struggle for the smaller players to scale and generate cash flows needed to support current operations. Q2 revenues came in as expected – minimal sequential growth, but...

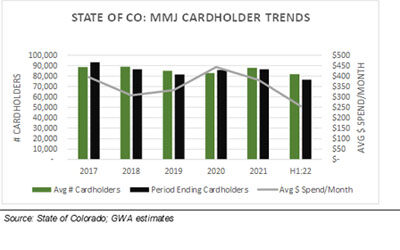

Colorado Market Declining and Takes Another Big Hit in Q2 – 4th Consecutive Quarter with Negative Comps

For the fourth consecutive quarter, The Colorado Department of Revenues posted negative comps both QoQ and YoY. For the six months ending June 30th, sales have fallen 21% to $906M mostly driven by a precipitous drop in Medical Marijuana (-46% ) due to new...

Recent Headlines, Commentary and Upcoming Catalysts

REGULATORY A Federal de-criminalization bill introduced in the Senate; not likely to pass but sets in motion further discussions. The Cannabis Administration and Opportunity Act (CAOA), was introduced into the Senate last month ( drafted March 2021). We share the...

Colorado’s Medical Marijuana Market Takes A Big Hit

KEY POINTS For the third consecutive quarter, The Colorado Department of Revenue posted neg comps for cannabis both YoY and QoQ. Q1:22 results -41% med / -13% rec YoY and -23% med / -11% rec QoQ. The deceleration in revenue growth is consistent with what we...

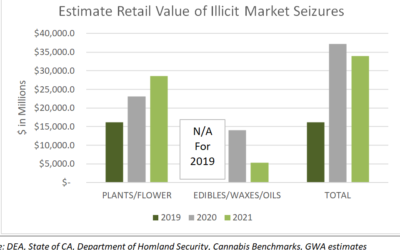

Weeding Out the Illicit Market

TAKEAWAY We reviewed and analyzed cannabis confiscations and related activities that were published by various state and federal agencies that enables us to determine a floor value for the illicit market. Its growth seemingly outpaced that of the legal market post...