The GreenWave

Buzz

Latest

Podcast

Investment

Landscape

In The

News

GreenWave

Capital Partners

Featured

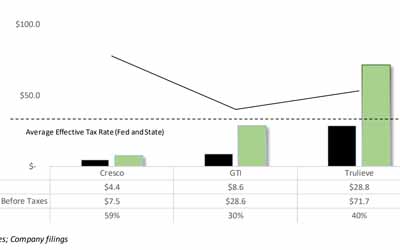

CASH IS KING – WHICH MSOs ARE MOST EFFICIENT?

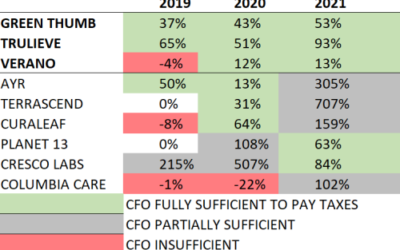

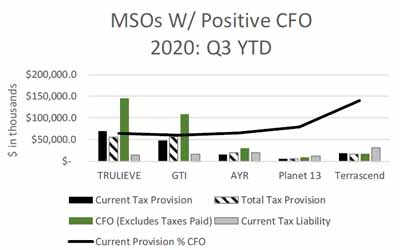

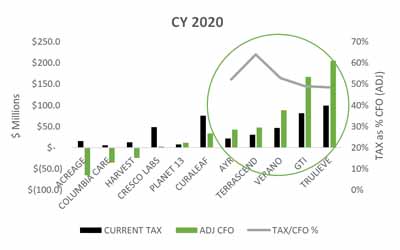

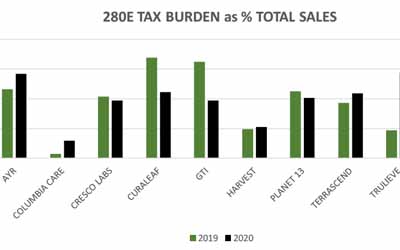

KEY POINTS: With 3 years of public disclosures, we are better able to analyze and assess the financial and operational performance of the U.S. Multistate Operators (MSOs). The added costs of prohibition (most notably 280E tax, which, in some cases can trigger...

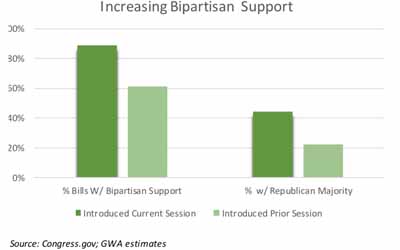

“MORE” IS LESS BUT BEWARE OF THE SNAKE IN THE “GRASS”

KEY POINTS: The eventual passage of the MORE Act mitigates several operational risks for cannabis businesses that touch the plant. The uncertainty around the timing of federal reform measures keeps valuations vulnerable to the impact of 280E. Most of the Multi-State...

Q ”4:20” and YE 2020 REVIEW

KEY POINTS Now on the cusp of federal reform (timing of which is unknown), the cannabis industry appears at an inflection point with the growth prospects and legitimacy we outlined in 2014 beginning to materialize. Our review of a grouping of publicly traded MSOs for...

”MORE” TAX REQUIRED TO RID THE (IRS) SNAKE IN THE “GRASS”

KEY POINTS: With two full years of public company disclosures, we provide a detail analysis that suggests a minimum federal excise tax of 10% upon the end of federal prohibition. The MORE Act currently includes a 5% excise tax (with a gradual increase to 8% over three...

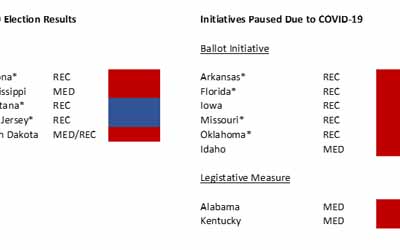

Regardless of a Blue Wave, Here Comes the Green Wave!

Our inaugural “GeenWave Report” (2014) indicates, “The overall growth in the U.S. legal marijuana industry is substantial and will be fueled by the implementation of additional legalized markets across the country as momentum continues in favor of changes to...

Colorado Cannabis Sales Remain Resilient in September as the Shift from “Consumer” to “Patient “Continues

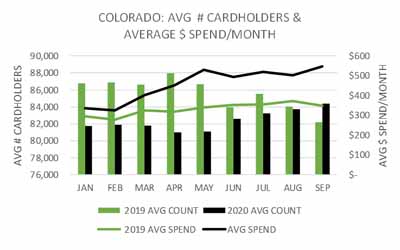

The state of Colorado’s marijuana tax revenues for September implies total monthly sales of $223.9M (+2% MoM; 44% YoY) with medical marijuana revenues at $46.2M (+10% MoM; 58% YoY) and recreational use ~$177.2M (+1%MoM; 47%YoY). We estimate that the average cardholder...

Buying Low and Selling High in Colorado: August Cannabis Purchasing Trends Continue to Suggest Shift from “Consumer” to “Patient”

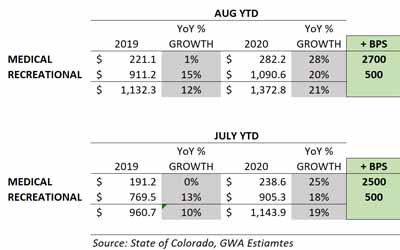

The state of Colorado released its marijuana tax revenues for August which implies total monthly sales of $228.9 (+11% MoM; 33% YoY) with medical marijuana revenues at $43.6M (+3% MoM; 41% YoY) and recreational use ~$185.3M (+13%MoM; 31%YoY). We estimate that...

THE STATE OF COLORADO: CANNABIS PURCHASING TRENDS SUGGEST A SWITCH FROM “CONSUMER” TO “PATIENT” AS DISPOSABLE INCOME LEVELS LESSEN DURING COVID-19 PANDEMIC

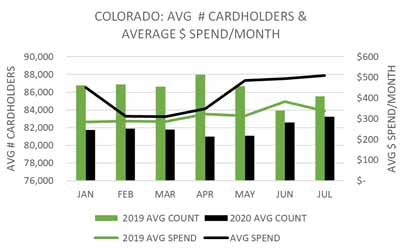

The state of Colorado released its marijuana tax revenues for July which implies total monthly sales of $206.7M (+ 7% MoM; 20% YoY) with medical marijuana revenues at $42.4M (+4% MoM; 42% YoY) and recreational use ~$164.2M (+8% MoM; 16%YoY). We estimate that the...

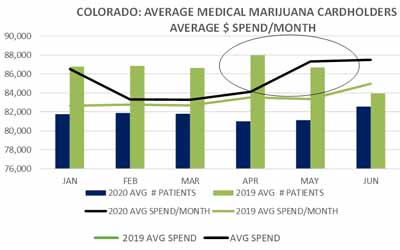

The State of Colorado: Medical Marijuana Cardholders Spend More Per Month During COVID-19 Pandemic

August 5, 2020 This week, the State of Colorado released its medical marijuana cardholder statistics for May and June. The average number of cardholders declined from ~86K in H1:19 to ~82K in H1:20 while the average patient $ spend/month increased to $400 from $313...

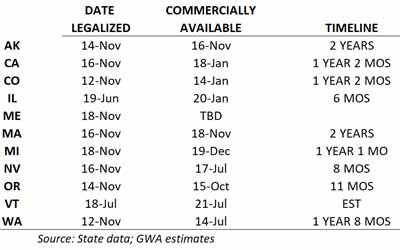

Clearing the Smoke: Is it Practical For a New State to Legalize Cannabis?

The complexities of the U.S. cannabis industry have been exacerbated by the consequences of states operating within the confines of closed economies defined by their own interpretations of legitimacy under the shadow of existing federal laws. These variations of...

PROHIBITION IS EXPENSIVE: SIT OR GET OFF THE “POT”

PROHIBITION IS EXPENSIVE: SIT OR GET OFF THE "POT" Many cannabis businesses are struggling, though not all the blame resides in faulty management decisions. In this edition of “The GreenWave Buzz,” we highlight the added costs of federal prohibition and discuss other...

A Little More Country, But Getting Ready to Rock and Roll

Welcome to “The GreenWave Buzz”, a periodic briefing intended to provide insights and analysis of various subject matters and business trends effecting the emerging cannabis industry. In this issue, we revisit our initial industry thesis and expectations from 2014,...

FAQ

In The News

Archived Research Reports

Who We Are And Why Are We Different

The firm was founded in March, 2014 by Matt Karnes, noted as one of the first to bring a professional pedigree to the emerging and complex cannabis industry. His tenure includes: Sellside Equity Research (Bear Stearns (JPMorgan), SG Cowen (Cowen), First Union Securities (Wells Fargo), Buyside Equity Analyst (L/S Equity Hedge Fund), Big 4 Public Accounting (PwC, Deloitte), Fortune 50 (Texaco Inc, Chase Bank). This wide range of experience establishes the firm's unique positioning as a trusted source readily able to connect the dots, read between the lines and ask the difficult and sometimes probing questions.

What We Do

We provide:

- Independent Financial Research and Analysis

- Buyside& Sellside Financial Analysis and Due Diligence

- Fund Manager and Direct Investment Due Diligence

- Valuation Services

- Cap Intro Advisory

To learn more, contact us at info@greenwaveadvisors.com

Our clients include:

- Institutional Investors

-

- Mutual Funds

- Hedge Funds

- Private Equity

- Venture Capital

-

- Family Offices

- High Net Worth Individuals

- Investment Banks (Equity Research)

- Cannabis License Applicants

- Cannabis Start Ups

The GreenWave Buzz – our proprietary analysis and commentary on what’s relevant in the cannabis space

Matthew A. Karnes, CPA

Founder

Matthew (Matt) Karnes has over 25 years of diverse finance and accounting experience. Prior to founding GreenWave Advisors LLC, Matt worked in equity research focusing on the Radio Broadcasting and Cable Television industries for First Union Securities. Matt also covered Satellite Communication at SG Cowen and in addition, worked with the top ranked Consumer Internet analyst at Bear Stearns & Co – this team was consistently recognized by the Institutional Investor’s “All America Research Team”. As a sellside equity analyst, Matt authored and co-authored numerous emerging industry research reports including such names as Google, Sirius, XM Satellite Radio, DIRECTV and EchoStar Communications.